Arbitrage Betting Guide: How Sure Bets Work in US Sportsbooks

Arbitrage betting is one of the most discussed strategies in US sports betting. The idea is straightforward: when two or more sportsbooks price the same market differently enough, you can bet both sides and lock in a mathematically guaranteed profit regardless of the outcome. In practice, the margins are small, the execution window is tight, and sportsbooks actively manage accounts that exploit pricing gaps. This guide covers everything you need to know about arbitrage betting, from the core maths and real examples to legality, tools, and what happens when things go wrong.

Use our free arbitrage calculator to size your stakes and test whether an opportunity qualifies as a true sure bet.

Arbitrage Betting in One Minute

Arbitrage betting means placing bets on every possible outcome of the same market across different sportsbooks so that your total payouts exceed your total stake no matter what happens. It works because different books set different prices, and occasionally those prices diverge enough to create a mathematical edge for the bettor.

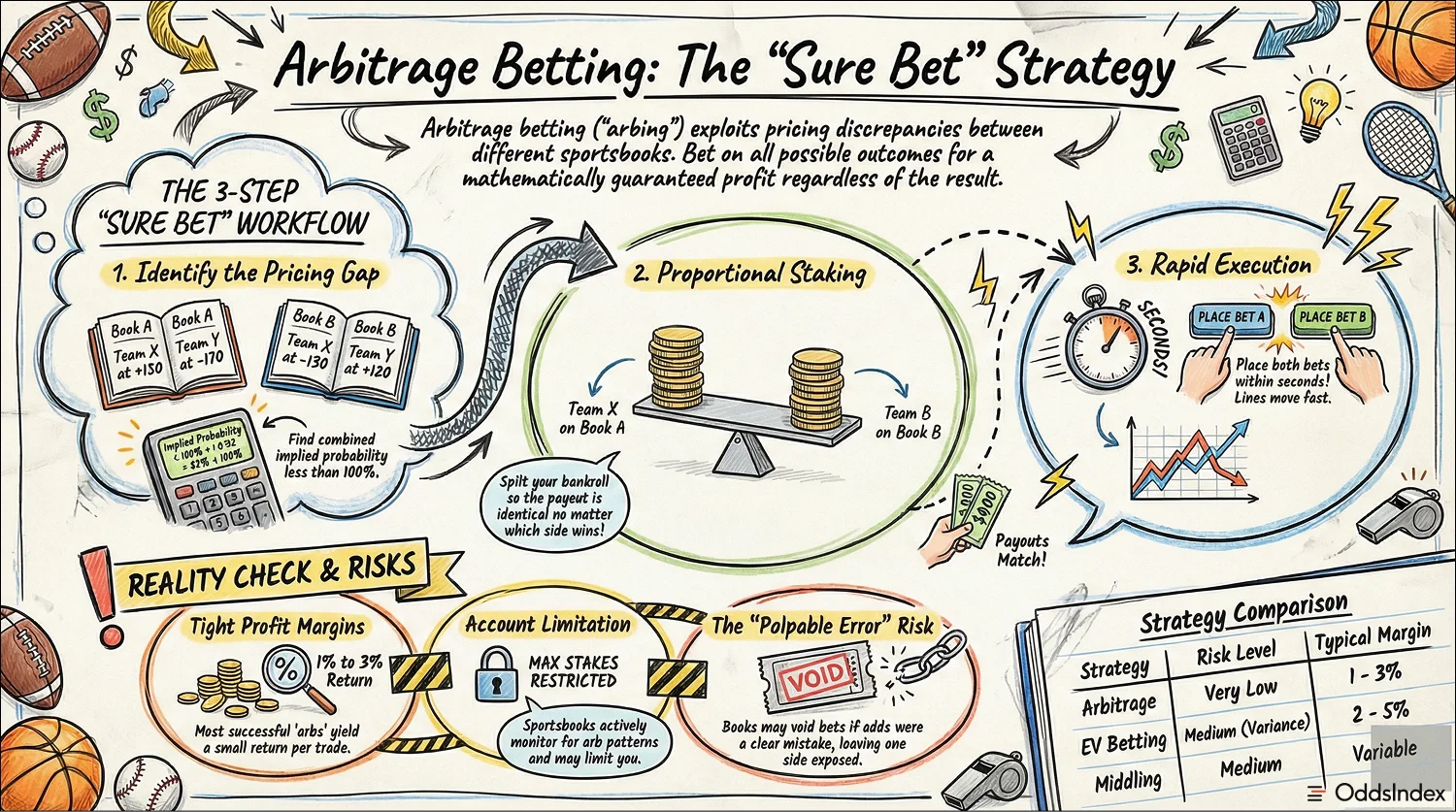

How it works in three steps:

- Find a pricing gap. Two sportsbooks offer odds on the same event that, when converted to implied probabilities, total less than 100 percent.

- Convert odds and confirm the arb. Use the implied probability formula for American odds to verify the opportunity is real.

- Stake proportionally. Split your total bet across both outcomes so that the payout is the same regardless of which side wins.

Reality check before you go further:

- Arb margins are small, typically 1 to 3 percent of total stake

- You need funded accounts at multiple sportsbooks and the ability to place both bets within seconds

- Sportsbooks monitor for arb patterns and will limit or restrict accounts that consistently exploit pricing differences

- Execution risk is real: odds can move, bets can be voided, and markets can have different settlement rules

- Arbitrage betting is legal in the US, but it is not the same as being welcomed by sportsbooks

Key takeaways:

- Arbitrage betting exploits pricing differences between sportsbooks to create positions where every outcome is covered at a profit

- True arbs require the combined implied probability across all outcomes to be below 100 percent

- Margins are typically 1 to 4 percent, meaning large bankrolls and fast execution are essential

- Sportsbooks can and do limit or restrict accounts that show arb patterns

- Arb betting is legal in the US but subject to each sportsbook's terms of service

What you will learn in this guide:

- How arbitrage betting works and why pricing gaps exist

- How to calculate arbitrage bets using American odds

- Real examples across NFL, NBA, and MLB markets

- How to use the OddsIndex arbitrage calculator

- A step-by-step workflow for finding arbs

- Software and tools for arbitrage betting

- Whether arbitrage betting is legal in the US

- How sportsbooks respond to arb bettors

- How arbitrage compares to hedging, middling, and EV betting

- The most common mistakes and failure modes

What Is Arbitrage Betting and How It Works

Arbitrage betting, sometimes called arbing or sure betting, is the practice of placing bets on all possible outcomes of a sporting event across different sportsbooks so that the combined payouts exceed your total stake. The concept borrows directly from financial arbitrage, where traders exploit price differences between markets to generate risk-free returns.

In sports betting, arbitrage opportunities arise because sportsbooks set their own odds independently. Each book has its own models, risk exposure, and margin targets. When their prices diverge enough on the same event, the gap can be large enough that a bettor who backs every outcome still comes out ahead.

Why arbs exist:

- Different sportsbooks use different pricing models and data feeds

- Books adjust lines at different speeds, especially around injury news or sharp action

- Promotional odds (boosted parlays, profit boosts) can create artificial pricing gaps

- Each book builds a different margin (vig or juice) into its lines, and sometimes those margins do not fully overlap

How a basic arbitrage bet works:

- Find a pricing gap. Two or more sportsbooks offer odds on the same market where the combined implied probabilities total less than 100 percent.

- Convert odds to implied probability. For American odds, the conversion formulas differ for favorites and underdogs. The key test: if the implied probabilities across all outcomes sum to less than 100 percent, an arb exists.

- Stake proportionally. You divide your total bankroll across the outcomes so that you receive the same (or similar) profit regardless of which side wins.

The profit margin on most arbs is small, typically between 1 and 4 percent of total stake. A 2 percent arb on a combined $1,000 stake yields $20 in guaranteed profit. That may not sound like much, but arb bettors aim to repeat this process many times.

Two-way vs three-way markets:

Most US sports betting markets are two-way: a moneyline with two sides, a spread with two sides, or a total with over and under. These are the simplest arbs to calculate and execute because you only need two bets.

Three-way markets, such as soccer 1X2 (home, draw, away), require three bets and are more complex. The implied probability test is the same (all three must sum below 100 percent), but the staking and execution become harder because you need accounts at potentially three different books and must place all bets before any line moves.

What Are Sure Bets in Sports Betting

The term "sure bet" is widely used in arbitrage betting, but it deserves a careful definition. A sure bet does not mean a bet that is guaranteed to win. It means a combination of bets across different sportsbooks where the mathematical structure guarantees a positive return if every bet is placed successfully at the quoted odds.

The word "sure" refers to the maths, not the execution. In practice, sure bets can fail for several reasons: odds can move before you place both sides, a sportsbook can void a bet due to a pricing error (palpable error rules), or your account can be limited to stakes too small to make the arb worthwhile. We cover all of these failure modes later in this guide.

A sure bet exists whenever the sum of implied probabilities across all outcomes is less than 100 percent. If Book A offers Team X at +150 and Book B offers Team Y at -130, you convert both to implied probabilities. If those probabilities total, say, 97.2 percent, the remaining 2.8 percent represents your potential arbitrage margin.

Understanding why pricing differences exist in the first place, including the role of vig and how books set their margins, helps you evaluate whether an arb is real or just a data lag. Our vig and true odds calculator guide explains how juice works and how to strip it from any line.

| Term | Definition |

|---|---|

| Arbitrage (arb) | Betting all outcomes of a market across different books to lock in profit |

| Sure bet | An arb opportunity where the maths guarantees positive return if executed correctly |

| Implied probability | The probability a set of odds implies, derived from the odds themselves |

| Vig (juice) | The margin a sportsbook builds into its odds to ensure profit |

| Palpable error | A clear pricing mistake that allows a sportsbook to void bets |

| Two-way market | A market with two outcomes (moneyline, spread, total) |

| Three-way market | A market with three outcomes (1X2 soccer, for example) |

Arbitrage Betting Calculator and Sure Bet Maths

The core of arbitrage betting is a simple mathematical test. If you can convert the odds from two or more sportsbooks into implied probabilities and those probabilities add up to less than 100 percent, you have an arb.

Converting American odds to implied probability:

For negative (favorite) odds, such as -150:

Implied probability = absolute value of the odds divided by (absolute value of the odds plus 100). So for -150: 150 / (150 + 100) = 150 / 250 = 0.600, or 60.0 percent.

For positive (underdog) odds, such as +130:

Implied probability = 100 divided by (the odds plus 100). So for +130: 100 / (130 + 100) = 100 / 230 = 0.4348, or 43.48 percent.

The sure bet test:

Add the implied probabilities for all outcomes. If the total is below 100 percent, an arb exists. If it is above 100 percent, the sportsbooks' combined vig eliminates any arb opportunity.

Example: Book A offers Team X at +150 (implied probability 40.0 percent) and Book B offers Team Y at -140 (implied probability 58.33 percent). Total: 40.0 + 58.33 = 98.33 percent. Since this is below 100 percent, there is an arb of approximately 1.67 percent.

Proportional stake splitting:

Once you confirm an arb exists, you need to calculate how much to bet on each side so that your payout is the same regardless of which outcome wins. The formula for each stake is:

Stake on outcome = (implied probability of that outcome / total implied probability) multiplied by your total bankroll.

Using the example above with a $1,000 total stake:

- Stake on Team X at +150: (40.0 / 98.33) x $1,000 = $406.78

- Stake on Team Y at -140: (58.33 / 98.33) x $1,000 = $593.22

If Team X wins: $406.78 x 2.50 = $1,016.95 (profit of $16.95)

If Team Y wins: $593.22 x 1.714 = $1,016.79 (profit of $16.79)

Either way, you profit roughly $17 on $1,000, a return of about 1.7 percent.

Our arbitrage calculator handles all of this maths for you. Enter the odds from each sportsbook and your total stake, and it instantly shows whether an arb exists, what to bet on each side, and your guaranteed profit.

American Odds Examples and Common Mistakes

Working with American odds introduces several common errors that can turn a profitable arb into a loss:

Plus/minus sign errors. The most basic mistake is entering a positive number when the odds are negative, or vice versa. An odds of -110 and +110 are very different implied probabilities (52.38 percent vs 47.62 percent). Double-check the sign before placing any bet.

Rounding and stake minimums. Many sportsbooks have minimum bet amounts (often $1 or $5) and round stakes to the nearest cent. On tight arbs, rounding errors can eliminate your margin entirely. If the calculator says to bet $4.87 and the book rounds up to $5.00, your balanced payouts shift.

Timing mismatch between books. The odds you see are not guaranteed until your bet is accepted. If you place one side of an arb and the line moves before you can place the other side, you may end up with an unbalanced position or no arb at all. Speed matters, and live odds change in seconds.

Market mismatch. Not all "same" markets are actually the same. One book might settle a total on regulation time only while another includes overtime. Spread markets can have different rules for ties. Always verify that both sides of your arb refer to the same event, same settlement rules, and same market.

Arbitrage Betting Examples with US Odds

Real arb opportunities appear across all major US sports. Here are three worked examples using typical pricing scenarios.

Example 1: NFL Spread Arb

NFL spread arbs typically appear when one book is slow to adjust after sharp action moves the line at other books, or when alternate spread pricing creates gaps that the standard line does not.

Consider an NFL game where both books offer the same spread but at different prices:

- Book A: Team X -3.5 at -110 (implied probability: 52.38 percent)

- Book B: Team Y +3.5 at +105 (implied probability: 48.78 percent)

- Total implied probability: 101.16 percent

This is NOT an arb. The combined implied probability is above 100 percent, meaning the books' vig more than covers any pricing gap. However, if Book B moves to +115 after adjusting for injury news while Book A lags behind:

- Book A: Team X -3.5 at -110 (implied probability: 52.38 percent)

- Book B: Team Y +3.5 at +115 (implied probability: 46.51 percent)

- Total implied probability: 98.89 percent

- Arb margin: 1.11 percent

Now the gap is wide enough to exploit. With a $2,000 total stake:

| Bet | Odds | Implied Prob | Stake | Payout if Wins |

|---|---|---|---|---|

| Team X -3.5 (Book A) | -110 | 52.38% | $1,059.47 | $2,022.25 |

| Team Y +3.5 (Book B) | +115 | 46.51% | $940.53 | $2,022.14 |

| Total | 98.89% | $2,000.00 | ~$2,022 |

Guaranteed profit: approximately $22 regardless of outcome (1.1 percent return). Note that the stakes are not equal: you bet more on the favorite side (-110) because that side pays out less per dollar wagered. The calculator balances the payouts so the dollar return is the same either way.

This type of spread arb is one of the most common in NFL betting because the market is so heavily traded that even small pricing disagreements between books can create exploitable gaps, especially in the hours before kickoff when line movement accelerates.

Example 2: NBA Moneyline Arb

NBA moneyline arbs tend to appear around game time when injury reports or lineup changes cause books to reprice at different speeds. One book might already reflect that a key player is sitting, while another has not adjusted yet.

- Book A: Celtics at +120 (implied probability: 45.45 percent)

- Book B: Lakers at -115 (implied probability: 53.49 percent)

- Total implied probability: 98.94 percent

- Arb margin: 1.06 percent

With a $1,500 total stake:

| Bet | Odds | Implied Prob | Stake | Payout if Wins |

|---|---|---|---|---|

| Celtics ML (Book A) | +120 | 45.45% | $689.04 | $1,515.89 |

| Lakers ML (Book B) | -115 | 53.49% | $810.96 | $1,516.05 |

| Total | 98.94% | $1,500.00 | ~$1,516 |

Guaranteed profit: approximately $16 (1.06 percent return). Even though the margin is just over 1 percent, this type of moneyline arb is attractive because NBA moneylines tend to have higher limits than props or alternate lines, allowing you to scale up your total stake.

Example 3: MLB Totals Arb

MLB totals arbs are particularly interesting because different books weight pitching matchups, bullpen usage, and weather conditions differently. A day game at Coors Field might see significant pricing divergence on the total because books disagree about how much altitude and afternoon heat affect run scoring.

- Book A: Over 8.5 at -105 (implied probability: 51.22 percent)

- Book B: Under 8.5 at +110 (implied probability: 47.62 percent)

- Total implied probability: 98.84 percent

- Arb margin: 1.16 percent

With a $1,000 total stake:

| Bet | Odds | Implied Prob | Stake | Payout if Wins |

|---|---|---|---|---|

| Over 8.5 (Book A) | -105 | 51.22% | $518.23 | $1,011.63 |

| Under 8.5 (Book B) | +110 | 47.62% | $481.77 | $1,011.72 |

| Total | 98.84% | $1,000.00 | ~$1,012 |

Guaranteed profit: approximately $12 (1.16 percent return).

What these examples tell you:

Notice the pattern across all three examples: arb margins are tight, consistently falling in the 1 to 2 percent range. A $1,000 arb yields $10 to $20 in profit. To generate meaningful income, you need a large bankroll, many successful executions, and the ability to act quickly before lines converge.

Also notice that the stake split is never 50/50. The ratio depends on the odds on each side. The shorter-priced side (the favorite) always receives the larger stake because its payout per dollar is lower. Getting this ratio wrong, even by a small amount, can turn a profitable arb into a break-even or losing position. This is why using a calculator is so important for getting the exact stakes right every time.

How to Use the OddsIndex Arbitrage Calculator

Our arbitrage calculator eliminates the manual maths and helps you confirm whether an opportunity is a true arb before you risk real money.

What the inputs mean:

- Odds for Outcome 1: Enter the American odds from the first sportsbook (for example, +120 or -150)

- Odds for Outcome 2: Enter the American odds from the second sportsbook for the opposite outcome

- Total Stake: The total amount you want to invest across both bets

What the outputs mean:

- Arb percentage: The margin of your arbitrage opportunity. A positive percentage means an arb exists. A negative percentage means the combined vig eliminates any opportunity.

- Stake for each outcome: The exact dollar amount to bet on each side to balance your payouts

- Guaranteed profit: The dollar amount you will receive regardless of which outcome wins, assuming both bets are placed and settled at the quoted odds

Walkthrough using Example 2 (NBA Moneyline):

- Enter +120 for the Celtics moneyline (Book A)

- Enter -115 for the Lakers moneyline (Book B)

- Enter $1,500 as your total stake

- The calculator shows an arb of approximately 1.06 percent, recommends $689.04 on the Celtics and $810.96 on the Lakers, and displays a guaranteed profit of roughly $16

If you change the Lakers odds from -115 to -125, the arb disappears. The calculator will show a negative arb percentage, telling you the combined vig exceeds the pricing gap. This instant feedback saves you from placing a trade that would guarantee a loss instead of a profit.

When to use the calculator versus manual maths:

For quick screening, you can often estimate in your head whether an arb is close. If one side is +130 and the other is -125, the gap looks promising. But you should always run the exact numbers through the calculator before placing real money. Small differences in implied probability, compounded by rounding and stake minimums, can flip a marginal arb from positive to negative. The calculator eliminates this guesswork and gives you precise stakes calibrated to your total bankroll.

Tips for using the calculator effectively:

- Double-check market match. Make sure both odds refer to the same event, same market type, and same settlement rules before entering them.

- Account for stake limits. If one sportsbook has a maximum bet of $500 and the calculator recommends $810 on that side, the arb is not executable at that size. Adjust your total stake downward.

- Verify stake minimums. If the calculator recommends $4.30 on one side and the book has a $5 minimum, your payouts will not balance correctly.

- Act fast. Odds change constantly. The arb you calculate may disappear within minutes or even seconds. Have accounts funded and ready to bet on both books before you start looking for arbs.

Common calculator workflow:

The most efficient approach is to have the calculator open alongside your sportsbook apps. When you spot a potential pricing gap during line shopping, immediately enter both sets of odds into the calculator. If the arb percentage is positive and the margin is worth pursuing (most bettors set a personal threshold of at least 1 percent), enter your desired total stake and note the exact amounts for each side. Then place both bets in rapid succession, starting with the side most likely to move.

The calculator provides estimates based on the odds you enter. Actual outcomes depend on accurate odds input, successful bet placement at the quoted lines, and normal settlement by both sportsbooks. The calculator does not guarantee profits or outcomes.

How to Find Arbitrage Bets

Finding arbitrage bets requires a systematic approach. Here is a practical workflow you can follow:

Step 1: Set up accounts at multiple sportsbooks.

You need active, funded accounts at several regulated US sportsbooks. The more books you have access to, the more pricing differences you can find. Focus on books with different pricing engines and risk philosophies, as these are more likely to diverge on the same market.

Step 2: Choose your markets.

Start with high-liquidity markets where odds are widely available: NFL and NBA moneylines, spreads, and game totals. These markets are priced by every major book and have the most consistent opportunity for price divergence. As you gain experience, expand to MLB totals, NHL moneylines, and prop markets.

When selecting markets, consider that different sports offer different arb characteristics. NFL spreads often have the tightest pricing because the market is so liquid, but alt lines and game props can show larger gaps. NBA moneylines, especially for games with uncertain injury reports, can produce pricing divergence as books react at different speeds to lineup news. MLB run totals are a reliable arb market because different books weight pitching matchups differently.

Step 3: Compare lines across books.

Open multiple sportsbook apps or websites and compare the odds on the same market. Line shopping is the foundation of finding arbs. You are looking for situations where one book has a significantly different price than another on the opposite outcome.

Step 4: Run the sure bet test.

Convert the best odds you find on each side to implied probabilities. If the total is below 100 percent, you have a potential arb. Use the arbitrage calculator to confirm and calculate stakes.

Step 5: Verify market details.

Before placing any bets, confirm that both sides refer to the same event, period, and settlement rules. Check for overtime inclusion, alternate lines versus main lines, and any sport-specific rules that could cause settlement differences.

Step 6: Place both bets as quickly as possible.

Speed is critical. Place the side you expect to move first (typically the sharper book), then immediately place the other side. The longer you wait between placing each leg, the greater the risk that the line moves and your arb disappears.

Step 7: Record everything.

Track every arb you attempt: the odds at each book, the time you placed each bet, your stakes, and the outcome. This record helps you identify which books and markets produce the most arbs and spot patterns in your success rate.

What to track for each arb opportunity:

- Event and market type

- Odds at each sportsbook and the time you checked them

- Implied probability total

- Calculated stakes for each side

- Actual stakes placed (accounting for rounding or limits)

- Time between placing the first and second bet

- Outcome and actual profit or loss

Pre-game arbs vs prop arbs vs derivatives:

Pre-game moneylines and spreads are the most common arb markets because they are widely priced and have decent limits. Prop markets (player props, team props) can show larger pricing gaps because fewer books price them and models vary more, but limits are often lower and void risk is higher. Derivative markets like alternate lines and totals fall somewhere in between.

Live Betting Arbitrage and Timing Risk

Live (in-play) arbitrage is the idea of finding pricing gaps during a game as odds update in real time. While the gaps can be larger during live betting because books reprice at different speeds, the practical challenges are severe.

Why live arbs are fragile:

- Latency matters. Even a one-second delay between checking one book and placing on another can mean the odds have changed. Live odds can shift on every play, pitch, or possession.

- Bet acceptance is not guaranteed. Many books use a review or delay system for live bets. Your bet may be pending for several seconds while the odds continue to move.

- Market suspension. Books routinely suspend live markets during scoring plays, timeouts, and reviews. You cannot place the second leg of an arb if the market is suspended.

- Rapid repricing. Live pricing algorithms are designed to close gaps quickly. By the time you identify a live arb, it may already be gone.

If you attempt live arbs, manage risk carefully:

- Use smaller stakes than you would for pre-game arbs

- Avoid volatile moments (end of quarters, two-minute warnings, bases loaded)

- Confirm bet acceptance on both sides before assuming the arb is locked in

- Accept that a significant portion of live arb attempts will fail due to timing

Software and Tools for Finding Arbitrage Bets

Manual line comparison works but is time-consuming. Several categories of software exist to help identify arb opportunities more efficiently.

Odds comparison tools and screeners:

These tools pull odds from multiple sportsbooks into a single interface so you can compare lines at a glance. Some highlight two-way markets where the combined implied probability is below a threshold you set. They speed up the "find a pricing gap" step of your workflow.

Dedicated arbitrage finders:

These go further by automatically calculating the arb percentage and recommended stakes for every qualifying opportunity. They typically refresh odds every few seconds and alert you when new arbs appear.

Alerting and notification services:

Some tools push notifications when arbs above a certain margin appear. This lets you react quickly without constantly monitoring screens.

| Tool Category | What It Does | Pros | Cons |

|---|---|---|---|

| Odds screener | Compares odds across books in one view | Fast visual comparison, often free or low cost | Manual arb identification, no auto-staking |

| Arb finder | Auto-calculates arb percent and stakes | Saves time, catches opportunities you might miss | Monthly subscription cost, may increase limitation risk |

| Alert service | Pushes notifications for qualifying arbs | React quickly, do not need to monitor constantly | Alerts may be delayed, competitive (many users see same arb) |

How to evaluate arbitrage tools:

- Book coverage: Does the tool include the sportsbooks available in your state? A tool that covers 20 international books but only 3 US books is less useful for US bettors.

- Refresh rate: How often does the tool update odds? Faster refresh means you see arbs closer to real time, but even "real-time" tools have some lag.

- Market depth: Does it cover only moneylines and spreads, or also totals, props, and futures? More market coverage means more potential arbs.

- Transparency: Does the tool show you the raw odds and its calculations, or just a "bet this" recommendation? You should always verify the maths independently before placing real money.

Arbitrage Finders and Odds Screeners

The most popular category of arbitrage software is the odds screener that doubles as an arb finder. These tools aggregate odds feeds from multiple sportsbooks and display them side by side. More advanced versions automatically calculate the arb percentage for every available market, filter by margin threshold, and provide stake recommendations.

Key features to look for in an odds screener:

- State filtering. You need to see odds only from books available in your state. A tool that shows you a 3 percent arb between two books that do not operate in your jurisdiction is useless.

- Historical data. Some tools show how long an arb has been available and how the gap has changed over time. This helps you assess whether the opportunity is real or likely already gone.

- Stake calculator integration. The best tools let you enter your bankroll and immediately see recommended stakes for each side, saving you the step of switching to a separate calculator.

Important caveats about tools:

No software can guarantee execution. A tool can find an opportunity and calculate optimal stakes, but it cannot control whether the sportsbook accepts your bet at those odds or limits your stake. Tools also increase limitation risk because if many users are seeing the same arbs from the same tool, sportsbooks notice the coordinated betting patterns.

Be cautious about any tool that promises guaranteed profits or positions itself as a way to "beat the books." The tool finds opportunities; you still bear all the execution risk. And any tool with a large user base means more competition for the same arbs, which means faster line movements and shorter windows to act.

Is Arbitrage Betting Legal in the US

This is one of the most searched questions around arbitrage betting, and the answer has important nuances.

Arbitrage betting is legal in the United States. There is no federal or state law that prohibits a bettor from placing wagers at multiple sportsbooks on different outcomes of the same event. You are not committing fraud, manipulating an event, or engaging in any criminal activity by arbitrage betting.

However, legality and permission are different things.

State regulation context:

Sports betting is regulated state by state. Each state's gaming commission oversees the sportsbooks operating within its borders. These commissions regulate the operators, not the individual betting strategies of customers. No US gaming commission has ruled arbitrage betting illegal for bettors.

Sportsbook terms of service:

Every sportsbook has terms and conditions that you agree to when you create an account. While these terms rarely explicitly mention "arbitrage betting," they almost universally include clauses that give the operator discretion to:

- Limit or reduce the maximum bet you can place on any market

- Restrict your account from accessing certain promotions

- Close your account with your balance returned (but with no future access)

Sportsbooks view consistent arb betting as exploitation of their pricing errors, and they respond by managing their risk through account restrictions rather than legal action.

The distinction between "legal" and "allowed":

This is where many bettors get confused. Something can be completely legal under the law while still being against the rules of a private company. Counting cards in blackjack is a useful analogy: it is not illegal, but casinos can ask you to leave and refuse your action. Arb betting works the same way. The law permits it. The sportsbook does not have to welcome it.

What about states with "duty to transact" or consumer protection rules?

Some states have stronger consumer protection frameworks than others, and there has been ongoing debate about whether regulated sportsbooks should be required to accept all legal bets. As of now, no US state has successfully enforced a requirement that sportsbooks must serve arbitrage bettors without limitation. The regulatory landscape continues to evolve, and this is an area worth monitoring.

What this means in practice:

You will not be arrested, fined, or prosecuted for arbitrage betting. But you may find your accounts limited to the point where arbing is no longer practical. This is not a legal consequence; it is a business decision by the sportsbook under the broad discretion granted by their terms.

Bottom line on legality:

Arbitrage betting is legal. It is not fraudulent, it is not match-fixing, and it does not violate any gambling statute. The real constraint is not the law but the terms of service and the practical reality that sportsbooks control access to their platforms.

This guide is for educational and informational purposes only. Nothing here constitutes legal or financial advice. Consult your own advisors for guidance specific to your situation.

Do Sportsbooks Ban or Limit Arbitrage Bettors

Understanding how sportsbooks respond to arb betting is essential before you invest significant time and money into this strategy.

Limiting vs banning vs promo restriction:

- Limiting means the sportsbook reduces the maximum stake you can place on a market. Instead of being able to bet $500 on an NFL spread, you might be limited to $10 or $25. This is the most common response and effectively ends your ability to arb on that book at meaningful sizes.

- Banning (account closure) means the sportsbook closes your account entirely and returns your remaining balance. This is less common than limiting but does happen, especially after repeated patterns.

- Promo restriction means you lose access to odds boosts, profit boosts, free bets, and other promotional offers. Since promotions create many of the largest arb opportunities, losing promo access significantly reduces your opportunity set.

Why patterns trigger attention:

Sportsbook risk management teams look for several signals:

- Consistently betting on the opposite side from where a line moves (suggesting you are exploiting stale pricing)

- Betting only on markets and lines where their prices are outliers

- Large, precise stakes that match arb calculator output (for example, $487.23 rather than round numbers)

- Rapid account registration followed immediately by high-volume betting

- Betting patterns correlated with known arb tool alerts

What to do instead of trying to evade limits:

Account evasion tactics (multi-accounting, using other people's accounts, VPNs) violate sportsbook terms of service and can create real legal problems. They are not recommended. Instead, consider strategies that are sustainable long-term:

- Line shopping. You can find better prices without necessarily arbing. Effective line shopping improves your returns over time without triggering the same red flags.

- EV betting. Instead of locking in guaranteed but tiny profits, EV betting identifies bets with positive expected value and accepts short-term variance for better long-term returns. See our expected value betting guide for a deeper look.

- Bankroll discipline. Good money management extends the life of your accounts and your bankroll regardless of strategy.

| Risk | What Happens | Mitigation |

|---|---|---|

| Account limiting | Max stakes reduced to very small amounts | Diversify across many books; avoid obvious patterns |

| Account closure | Account closed, balance returned | No reliable prevention; have accounts at many books |

| Promo restriction | Lose access to boosts and free bets | Do not use promos exclusively for arbing |

| Voided bet | One side voided under palpable error rules | Avoid obviously mispriced lines; verify odds are reasonable |

Bankroll, Staking, and What ROI Is Realistic

Arbitrage betting requires a larger bankroll than most betting strategies because your capital is split across multiple sportsbooks and the margins are thin.

Why bankroll size matters:

If you have $5,000 spread across five sportsbooks ($1,000 each) and a typical arb requires $800 on one side and $1,200 on the other, you may not have enough in the right account to execute. Frequent deposits and withdrawals between books are possible but add friction, time, and sometimes fees.

Realistic margins:

Most arb opportunities in the regulated US market fall in the 1 to 3 percent range. Larger margins (4 percent or above) are rare and often indicate either a pricing error that may be voided or a market mismatch that will not settle as expected.

What this means for returns:

If you can execute one $1,000 arb per day at an average margin of 1.5 percent, that is $15 per day, or roughly $450 per month. This requires having enough total bankroll distributed across books to fund daily arbs, and it assumes you do not get limited on any of those books during that period.

Record-keeping basics:

Disciplined arb bettors track every attempt in a spreadsheet or database:

- Date and event

- Sportsbooks used

- Odds and stakes on each side

- Calculated margin versus actual profit

- Any issues (bet rejection, line movement, voids)

This data helps you calculate your actual ROI, identify which books and markets are most productive, and notice when limitation is reducing your effective opportunity set.

Arbitrage Betting vs Hedging, Middling, and EV Betting

Arbitrage betting sits within a family of advanced strategies that share some mechanics but differ in intent, timing, and risk profile.

Arbitrage vs hedging:

Both involve betting on opposite outcomes, but the timing and purpose differ. Arbitrage is planned from the start: you identify a pricing gap and bet both sides simultaneously. Hedging happens after you already have an open bet and want to reduce your risk or lock in a profit based on how a situation has developed (for example, your futures bet is close to winning and you want to guarantee some payout).

Our hedge calculator guide covers the mechanics of hedging in detail, including equal profit mode, break-even mode, and custom profit scenarios.

Arbitrage vs middling:

Middle betting involves betting on both sides of a spread or total at different numbers, hoping the final result lands between them. Unlike arbitrage, where you are guaranteed a profit if executed correctly, middling has a risk: if the result does not land in the middle, you lose the vig on one side. However, when a middle hits, the payout can be substantial because you win both bets.

Example: You bet Team A -3 and later find Team B +5 on another book. If Team A wins by 4, you win both bets. If they win by 2 or by 6, you win one and lose one (minus the vig difference).

Arbitrage vs EV betting:

This is the most important comparison for anyone considering arbing as a long-term strategy. Arbitrage locks in small, guaranteed profits with no variance. EV (expected value) betting identifies bets where the true probability gives you a mathematical edge, but each individual bet can win or lose.

EV betting is more scalable because:

- You only need to bet one side per opportunity (no split across books)

- Sportsbooks are slower to limit one-sided betting that does not match obvious arb patterns

- The average return per bet can be higher, even though individual results vary

- You do not need simultaneous accounts at multiple books for the same event

The trade-off is variance. An EV bettor will have losing days, losing weeks, and sometimes losing months, even if their strategy is sound over thousands of bets. An arb bettor, assuming clean execution, profits on every single trade.

The trade-off matters because it affects how you think about your betting activity day to day. An arb bettor needs to find and execute opportunities in real time, managing multiple accounts and moving quickly. An EV bettor can be more deliberate, placing one bet at a time and trusting that the maths will work out over a large sample size. Both require discipline, but the daily experience is quite different.

For many bettors, the progression is: learn arbing to understand pricing mechanics, then transition to EV betting for sustainability. Arbing teaches you how sportsbooks price markets, how to convert odds, and how to think about implied probability. Those skills transfer directly to identifying value in individual bets. Our expected value betting guide explains this approach in depth.

| Strategy | Risk Level | Typical Margin | Scalability | Account Limitation Risk |

|---|---|---|---|---|

| Arbitrage | Very low (if executed correctly) | 1-3% | Low (limited by account limits) | High |

| Hedging | Low to medium | Varies | Medium | Low |

| Middling | Medium (can lose vig) | Variable (big wins possible) | Medium | Medium |

| EV betting | Medium (short-term variance) | 2-5% per bet | High | Medium |

Mistakes to Avoid and Common Failure Modes

Even when the maths is correct, arb bets can fail. Here are the most common ways arbitrage bettors lose money:

Not matching identical markets:

This is the number one mistake. You think you are arbing the same market, but the two books have different settlement rules. One book settles totals on regulation time only; the other includes overtime. One book voids bets on a pitcher change; the other does not. Always read the market rules on each sportsbook before placing an arb.

Odds moving mid-execution:

You place the first leg of your arb, then switch to the second book and find the line has already moved. Now you have an unbalanced position. If the second book has moved enough, you may not even have an arb anymore. You are left with a single bet at no particular edge, or worse, a guaranteed loss if you try to force the second leg at worse odds.

Voids and palpable error rules:

Sportsbooks reserve the right to void bets placed at obviously incorrect odds. If a book accidentally posts -110 when they meant +110, they can void all bets on that market. If one side of your arb is voided, you are left with a single exposed bet that may lose.

Dead heat and overtime rules:

In some sports and markets, ties, dead heats, or overtime periods change how bets are settled. If your arb depends on specific settlement rules and the event triggers an exception, your balanced position can become unbalanced.

Withdrawal and verification friction:

When you win consistently across multiple books, expect identity verification requests, additional documentation requirements, and sometimes withdrawal delays. This is standard compliance procedure, but it ties up your bankroll and slows your ability to recycle capital into new arbs.

Currency of account and payment method restrictions:

If you are arbing across books that use different deposit and withdrawal methods, watch out for processing times and fees that eat into your margins. A 1.5 percent arb that costs you 1 percent in deposit fees and withdrawal charges is barely worth executing. Stick to books where you can move money efficiently and cheaply.

Stake size signals:

Betting $487.23 on a spread bet is an obvious tell that you are following a calculator. While rounding to nice numbers introduces some imbalance, it can help your account longevity. The trade-off between perfect mathematical balance and practical account management is something every arb bettor must navigate.

Not having a plan for when one leg fails:

Before placing any arb, decide in advance what you will do if the second leg cannot be placed. Will you let the first bet ride as a standalone wager? Will you hedge at worse odds and accept a small loss? Having a contingency plan prevents panic decisions that often lead to bigger losses than the arb would have generated in profit.

Checklist before placing any arb:

- Confirm both bets are on the same event, same market type, and same settlement rules

- Verify the odds are still available at both books before placing either bet

- Check that you can bet the full calculated stake at both books (no limits below your required amount)

- Have both sportsbook accounts open and funded before you start

- Place both bets as quickly as possible, starting with the side you expect to move first

- Record the exact odds and stakes placed on each side

- Monitor settlement and confirm both bets are settled correctly

Frequently Asked Questions

Is arbitrage betting legal in the US?

Yes. There is no federal or state law that prohibits placing bets on different outcomes of the same event at different sportsbooks. Arbitrage betting is a legal betting strategy. However, sportsbooks can limit or close your account under their terms of service if they detect consistent arb patterns. This is a business decision by the operator, not a legal consequence for the bettor.

Is arbitrage betting risk-free?

The maths behind arbitrage betting is designed to guarantee a profit if both bets are placed and settled at the quoted odds. In practice, several factors introduce risk: odds can move before you place both sides, one bet can be voided due to palpable error rules, your stake can be limited below the required amount, or the markets may have different settlement rules than you expected. Arb betting is low risk but not zero risk.

Can you lose money arbitrage betting?

Yes. The most common ways to lose money are: placing only one side before the odds change (leaving you with an unbalanced position), having one bet voided by the sportsbook, not matching identical markets (different settlement rules), and rounding or stake minimum issues that throw off your balanced payouts. Discipline, speed, and attention to detail reduce these risks but cannot eliminate them entirely.

Do sportsbooks ban or limit arbitrage bettors?

Most regulated US sportsbooks will limit accounts that show consistent arbitrage betting patterns. Limiting means reducing your maximum stake to very small amounts, effectively ending your ability to arb at meaningful sizes on that book. Outright account closure (banning) is less common but does occur. Promotional restrictions, where you lose access to boosts and free bets, are also common. These are standard risk management practices permitted under each sportsbook's terms of service.

How do you calculate an arbitrage bet?

Convert the American odds from each sportsbook into implied probabilities. For negative odds, divide the absolute value of the odds by (the absolute value of the odds plus 100). For positive odds, divide 100 by (the odds plus 100). Add the implied probabilities for all outcomes. If the total is below 100 percent, an arb exists. To calculate stakes, divide each outcome's implied probability by the total implied probability, then multiply by your total stake. Use our arbitrage calculator to automate this process.

How much money do you need for arbitrage betting?

Arbitrage margins are typically 1 to 3 percent, so you need a sufficient bankroll to make the absolute dollar profit worthwhile. Most practical arb bettors maintain at least a few thousand dollars spread across multiple sportsbook accounts. The limiting factor is often the maximum bet the sportsbook allows rather than your own bankroll, especially once you begin to get limited.

What is the difference between arbitrage betting and EV betting?

Arbitrage betting locks in a small, guaranteed profit by betting on all outcomes across different books. EV (expected value) betting identifies single bets where the true probability gives you a mathematical edge, accepting that each individual bet can win or lose. EV betting is more scalable and less likely to trigger account limitations, but it involves short-term variance. Many advanced bettors start with arbitrage to learn pricing mechanics and then transition to EV betting for long-term sustainability.

Gamble responsibly. If you or someone you know has a gambling problem, call +1-800-GAMBLER.