College Basketball Betting (2025-26 Guide)

College basketball betting offers one of the most exciting and action-packed wagering experiences in American sports. From the opening tip of the regular season in November through the chaos of March Madness, NCAAB provides bettors with hundreds of games each week across more than 350 Division I programs.

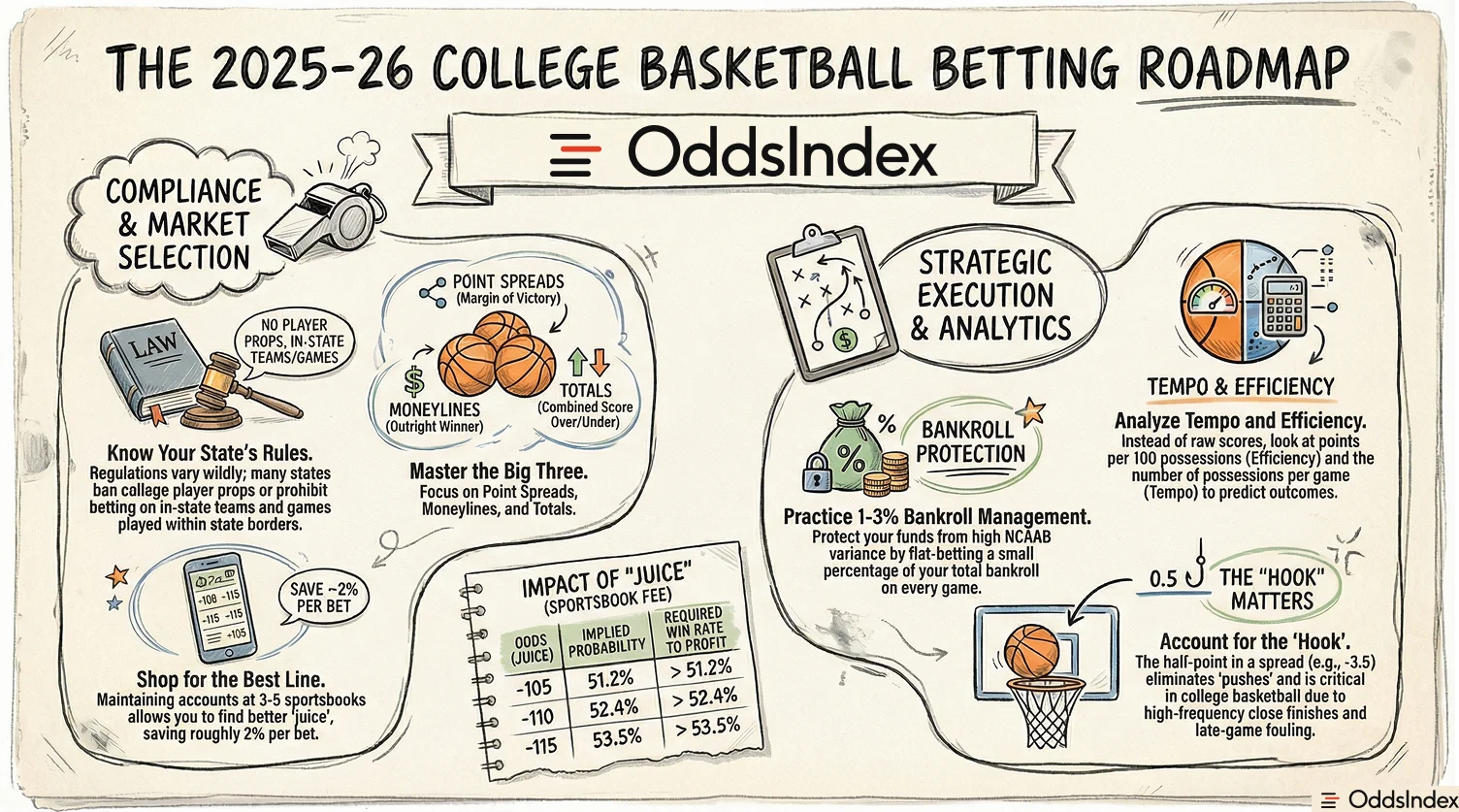

This guide covers everything you need to know about college basketball betting: how to read odds and lines, the step-by-step process for placing bets, state-by-state legal considerations (especially player props), sharp betting strategies, and how to use our odds converter calculator to make smarter decisions.

Whether you are crossing over from NFL or NBA betting or placing your first college basketball wager, this guide gives you the foundation to bet with confidence.

Important: Sports betting should be entertaining, not a source of financial stress. Set a budget before you bet, never chase losses, and take breaks when betting stops being fun. If you or someone you know struggles with gambling, resources are available at the end of this guide.

Quick Start: How College Basketball Betting Works

College basketball betting shares the same core bet types as other sports, but the sheer volume of games and variance across programs makes NCAAB unique.

What you can bet on:

| Bet Type | Description | Example |

|---|---|---|

| Point Spread | Bet on the margin of victory | Duke -6.5 (-110) |

| Moneyline | Bet on which team wins outright | Gonzaga -180, opponent +155 |

| Totals (Over/Under) | Bet on combined score | Over 145.5 (-110) |

| First Half/Second Half | Bet on one half only | Kentucky 1H -3 (-110) |

| Futures | Bet on season outcomes | UConn to win title +600 |

| Player Props | Bet on individual performances | Over 18.5 points (where legal) |

Why NCAAB betting is different from other sports:

- Massive variance: With 350+ programs and uneven talent distribution, you will see 20-point underdogs cover regularly. Upsets happen far more often than in professional leagues.

- Roster turnover: The transfer portal and NIL (Name, Image, Likeness) deals create constant roster changes. A team that lost the tournament last year might have an entirely different roster this season.

- Travel and scheduling: Teams play grueling non-conference schedules, travel across time zones, and face back-to-back games. Fatigue matters.

- Home-court advantage: Student sections, altitude (think BYU or Colorado), and hostile environments create genuine edges. Home teams cover at higher rates than in the NBA.

- Conference play patterns: Teams play each other twice in conference season. The second matchup often looks different as coaches adjust.

Compliance note: State rules vary significantly for college sports betting. Some states ban player props entirely for college athletes. Others restrict betting on in-state teams or games played within the state. Before placing any bet, check your state regulations.

Quick-start checklist:

- Confirm betting is legal in your state and understand any college-specific restrictions

- Choose a licensed sportsbook with competitive NCAAB lines and half markets

- Start with spread or totals bets (lower juice than moneylines for favorites)

- Track your results from day one

- Use our odds converter to understand implied probability before betting

How to Bet on College Basketball (Step-by-Step)

Placing your first college basketball bet is straightforward once you understand the process. Follow these five steps to get started, whether you are new to sports betting or transitioning from other sports.

Step 1: Confirm Legality in Your State

Before creating a sportsbook account, verify that:

- Sports betting is legal in your state (currently legal in 30+ states)

- College sports betting is permitted (some states exclude college entirely or restrict specific markets)

- Player props are allowed for college athletes (many states restrict or ban these entirely)

- You can bet on in-state teams (some states prohibit betting on local schools)

- You understand any geographic restrictions (some states ban betting on games played within their borders)

College basketball has more state-by-state restrictions than professional sports. Do not assume that because NBA betting is legal, all college basketball markets are available.

For the complete breakdown, see our college sports betting rules by state guide.

Step 2: Choose Your Market

College basketball offers several betting markets. Your choice depends on your analysis and risk tolerance. Each market type serves different purposes and suits different betting strategies.

Point spreads work best when you expect a close game or have a strong opinion on margin of victory. The spread adjusts for team quality differences. Example: Duke -6.5 means Duke must win by 7 or more for the bet to win. Spreads offer relatively low juice (typically -110 on both sides) and are the most popular college basketball market.

Moneylines work best for underdog bets or when you believe the favorite will win but are uncertain about the margin. For heavy favorites, the juice makes spreads more efficient. Example: If Duke is -300 on the moneyline (risk 300 dollars to win 100 dollars), the spread likely offers better value. Moneylines shine when betting underdogs you believe can win outright.

Totals (over/under) work best when you have insight into pace and efficiency. If you believe two teams will push tempo and shoot well, the over becomes attractive regardless of who wins. Totals are less efficient than spreads in college basketball because they receive less betting attention, creating opportunities for analytical bettors.

For detailed explanations, see our guides on spread betting and moneyline betting.

Step 3: Shop Lines and Understand Juice

Line shopping is one of the easiest ways to improve long-term results. Different sportsbooks offer different lines, and small differences add up over a season of betting. This step requires minimal effort but provides significant edge.

Example: You want to bet Duke -6.5.

- Sportsbook A: Duke -6.5 (-110)

- Sportsbook B: Duke -6.5 (-105)

- Sportsbook C: Duke -6 (-115)

Sportsbook B offers better juice. Sportsbook C offers a better number (a half-point can be the difference between a push and a loss). Depending on your confidence, either could be the best choice.

The standard juice of -110 means you risk 110 dollars to win 100 dollars. Over hundreds of bets, reducing juice to -105 or grabbing better numbers compounds significantly. A bettor who consistently gets -105 instead of -110 saves roughly 2% per bet, which translates to hundreds of dollars over a season.

How to line shop effectively:

- Maintain accounts at 3-5 licensed sportsbooks

- Before each bet, check the line at all available books

- Note both the spread number and the juice

- Place your bet at the book offering the best combination

- Track which books consistently offer value for your betting style

Step 4: Size Your Stake (Bankroll Basics)

Never bet more than you can afford to lose. Bankroll management protects you from variance and ensures you can continue betting through inevitable losing streaks.

A common approach is flat betting: wagering the same percentage of your bankroll on each bet, typically 1-3%. This prevents emotional escalation and ensures no single bet can devastate your bankroll.

Example bankroll approach:

- Total bankroll: 1,000 dollars

- Unit size (2%): 20 dollars per bet

- Maximum single bet: 50 dollars (5%)

- Never increase bet size to chase losses

This approach protects you during losing streaks and prevents emotional escalation. College basketball has high variance; even strong bettors experience extended cold streaks of 10+ losses. If you bet too large, variance can wipe out your bankroll before your edge has time to materialize.

Adjusting for confidence: Some bettors use tiered staking where they bet 1 unit on standard plays, 2 units on strong conviction bets, and reserve 3 units for rare high-confidence situations. If you use variable staking, be honest with yourself about past results at each tier.

Step 5: Track Results and Learn

From your first bet, record everything. Tracking is not optional if you want to improve. Without data, you cannot identify what works, what fails, or whether you are actually profitable.

Record for each bet:

- Date and game (for seasonal analysis)

- Bet type (spread, moneyline, total)

- Odds at bet time (to compare with closing line)

- Closing line (what the line was at tipoff)

- Result (win, loss, push)

- Notes on your reasoning (why you liked this bet)

- League and conference (some bettors perform better in certain conferences)

Closing line value (CLV) matters more than short-term results. If you bet Duke -6.5 and the line closes at Duke -7.5, you got a good number regardless of whether Duke covers. If you consistently beat the closing line, you are making good bets even if short-term variance goes against you. Track CLV religiously and review it monthly.

Monthly review questions:

- What is my overall win rate by bet type?

- Am I consistently beating closing lines?

- Are there conferences or situations where I perform better or worse?

- How did my high-confidence bets perform versus standard bets?

Spread vs Moneyline vs Total: Which Should You Use

The right market depends on your edge and the specific game situation. Each bet type serves different purposes, and understanding when to use each improves your long-term results.

Use spreads when:

- Games are expected to be competitive (ranked matchups, conference rivals)

- You have a strong opinion on margin of victory, not just the winner

- Betting favorites where moneyline juice is prohibitive (-200 or worse)

- The spread aligns with your efficiency-based projection

- You want lower juice than moneylines typically offer

Example spread decision: Duke is a 7-point favorite over Wake Forest. The moneyline is -280. You believe Duke wins by 8-12 points. The spread at -7 (-110) offers far better value than risking 280 dollars to win 100 dollars on the moneyline.

Use moneylines when:

- Betting underdogs you believe can win outright (upset potential)

- The spread feels too risky because the team could win but not cover

- Small favorites where moneyline juice is reasonable (-130 to -160 range)

- You want to avoid the variance of close finishes affecting your spread

- Tournament games where underdogs frequently win outright

Example moneyline decision: A 12-seed faces a 5-seed in March Madness. The spread is +6.5, but you believe the underdog wins outright. Taking +220 on the moneyline pays better than the spread if your read is correct.

Use totals when:

- You have insight into pace and efficiency that the market may not reflect

- Weather is a factor (outdoor early-season tournaments, altitude games)

- Team matchups suggest a style mismatch (up-tempo vs grind-it-out)

- You do not have a strong opinion on which team wins

- Injury news affects scoring but not necessarily the spread

Example totals decision: Two Big East teams averaging 78 points each face off with a total of 148.5. Your research shows both teams rank in the top 20 in tempo and neither defends well. The over looks attractive regardless of the spread.

Why totals can offer edges: Many sharp bettors focus on totals in college basketball because the market is less efficient than spreads. With 150+ games on a typical weeknight, sportsbooks cannot perfectly price every total. Spread markets get more attention and action, leaving totals with softer lines. Additionally, tempo and efficiency data directly inform totals analysis, giving analytical bettors a framework the casual market often ignores.

NCAA Basketball Odds and Lines Explained (With Examples)

Understanding how to read college basketball odds is essential before placing any bet. This section breaks down American odds, implied probability, and practical examples you will encounter when betting college basketball.

American Odds Basics

American odds use plus (+) and minus (-) signs to indicate favorites and underdogs. This is the standard format at US sportsbooks.

Negative odds (-110, -150, -200) indicate the favorite. The number shows how much you must risk to win 100 dollars.

- -110 odds: Risk 110 dollars to win 100 dollars (standard spread juice)

- -150 odds: Risk 150 dollars to win 100 dollars (small favorite on moneyline)

- -200 odds: Risk 200 dollars to win 100 dollars (moderate favorite on moneyline)

- -300 odds: Risk 300 dollars to win 100 dollars (heavy favorite, often poor value)

Positive odds (+120, +150, +250) indicate the underdog. The number shows how much you win on a 100-dollar bet.

- +120 odds: Win 120 dollars on a 100-dollar bet (slight underdog)

- +150 odds: Win 150 dollars on a 100-dollar bet (moderate underdog)

- +250 odds: Win 250 dollars on a 100-dollar bet (significant underdog)

- +500 odds: Win 500 dollars on a 100-dollar bet (heavy underdog or futures bet)

Quick reference: The larger the negative number, the bigger the favorite. The larger the positive number, the bigger the underdog.

Implied Probability and Why -110 Matters

Every odds line implies a probability. Converting odds to implied probability helps you compare your estimated chance of winning against the market. This is fundamental to finding betting value.

Implied probability formula for negative odds: Risk / (Risk + Win) = Implied probability

Example: -110 odds 110 / (110 + 100) = 110 / 210 = 52.4%

Implied probability formula for positive odds: 100 / (Win + 100) = Implied probability

Example: +150 odds 100 / (150 + 100) = 100 / 250 = 40%

Why -110 matters so much:

The standard -110 on both sides of a spread means each outcome has an implied probability of 52.4%. The combined 104.8% represents the sportsbook edge (the vig or juice). This 4.8% is how sportsbooks make money.

To profit long-term at -110, you must win more than 52.4% of your bets. Winning exactly 50% loses money due to the juice. This is why finding edges matters. A bettor who wins 55% of spread bets at -110 is profitable. A bettor who wins 50% loses steadily.

Comparing juice across books:

- -110 juice: Need 52.4% win rate to break even

- -105 juice: Need 51.2% win rate to break even

- -115 juice: Need 53.5% win rate to break even

The difference between -105 and -115 is roughly 2.3% in required win rate. Over hundreds of bets, this is significant.

Worked Example 1: Spread Bet

Game: Kansas -5.5 (-110) vs Baylor

- You believe Kansas wins by 7+ points based on efficiency analysis

- Risking 110 dollars to win 100 dollars

- Kansas must win by 6 or more for you to win

- If Kansas wins by exactly 5, you lose (the half-point matters)

- Implied probability: 52.4%

Analysis process: Before betting, compare your estimated probability of Kansas covering to 52.4%. If you believe Kansas covers 58% of the time, you have a 5.6% edge. If you believe Kansas covers only 50% of the time, pass on this bet.

Use our calculator below to convert any odds to implied probability.

Worked Example 2: Moneyline Bet

Game: Purdue -180, Illinois +155

Betting the favorite (Purdue -180):

- Risk 180 dollars to win 100 dollars

- Implied probability: 180 / 280 = 64.3%

- Purdue must simply win (margin does not matter)

Betting the underdog (Illinois +155):

- Risk 100 dollars to win 155 dollars

- Implied probability: 100 / 255 = 39.2%

- Illinois must win outright

The juice explained: The gap between 64.3% and 39.2% totals 103.5%. The 3.5% over 100% represents the juice. Sportsbooks profit regardless of outcome because the implied probabilities exceed 100%.

When to bet each side: If you believe Purdue wins 70% of the time, the moneyline has value. If you believe Illinois wins 45% of the time, the underdog has value. Compare your estimates to implied probability to find value.

Worked Example 3: Total Bet

Game: Duke vs North Carolina, Total 152.5 (-110/-110)

- Over 152.5 means combined score must be 153+

- Under 152.5 means combined score must be 152 or less

- Both sides at -110 mean standard juice

Analysis approach: Check both teams tempo and efficiency. If Duke averages 75 points and UNC averages 78, that suggests 153 combined. But consider defensive efficiency, game pace, and rivalry intensity. Duke-UNC games often play slower due to pressure defense, which might favor the under.

The Hook, Key Numbers, and Why Half-Points Matter

In college basketball, every half-point matters more than in football. Games frequently end within 1-2 points, and foul-game variance creates unpredictable finishes. Understanding the hook and key numbers helps you evaluate spreads.

The hook refers to the half-point in a spread. Kentucky -3.5 versus Kentucky -3 is a significant difference because games landing exactly on 3 are common. The half-point eliminates pushes and creates clear winners and losers.

Why half-points matter in college basketball:

- One team has a 3-point lead with 30 seconds left

- The trailing team fouls to stop the clock

- Free throws are made or missed, potentially pushing the margin to 4-5 or dropping it to 1-2

- This sequence happens in most close games

- A spread of -3 could push; a spread of -3.5 has a definitive outcome

Key numbers in NCAAB: Unlike football with its dominant 3 and 7, college basketball has no universally dominant key numbers. However, certain margins occur more frequently:

- 1, 2, and 3 are high-frequency margins because of free throw situations in the final minute

- 4 and 5 are moderately common as teams extend leads with late free throws

- 6 through 10 become less predictable and depend heavily on game flow

When to buy points: Buying points means paying extra juice to move the spread in your favor.

- Worth considering: Buying from -3.5 to -3, or from +2.5 to +3 (crossing through 3 is valuable)

- Sometimes worth it: Buying through 1 or 2 in close games

- Usually not worth it: Buying from -7.5 to -7 (7 is not a key number in basketball like football)

Example: You like Duke -3.5 (-110). The book offers Duke -3 (-120). Should you pay the extra juice? In college basketball, games land on exactly 3 often enough that paying 10 cents of juice is typically worthwhile. Calculate whether the probability of pushing justifies the cost.

Close-game variance: College basketball has more close finishes than professional basketball. Intentional fouls, free throw shooting variance, and late-game coaching decisions make the final two minutes highly unpredictable. A team up 5 with 2 minutes left might win by 3 or by 9 depending on fouling strategy and free throw results.

Underdog advantage: This close-game variance benefits underdog bettors over large samples. The favorite might control the game but lose the cover due to late free throws. Over hundreds of bets, this variance helps underdogs more than favorites.

How to Use the Odds Converter Calculator

Our odds converter helps you instantly translate between American, decimal, and fractional odds while showing implied probability. This removes guesswork and helps you compare value across sportsbooks. Understanding implied probability is fundamental to finding betting value, and this calculator makes the math instant.

Step-by-Step Calculator Usage

Follow this process each time you evaluate a college basketball bet:

-

Enter your odds: Input American odds (like -110 or +150) in the calculator. American odds are standard at US sportsbooks. The calculator accepts both positive and negative values.

-

View implied probability: The calculator instantly shows the percentage chance implied by those odds. This tells you how often you need to win to break even at those odds.

-

Compare to your estimate: This is the key step. If you believe Kansas has a 60% chance to cover and the implied probability is 52.4%, you have found potential value. The gap between your estimate and the implied probability represents your expected edge.

-

Check other formats: See decimal and fractional equivalents for comparison. Decimal odds are common internationally and multiply directly with your stake to show total return. Fractional odds show profit relative to stake.

-

Record the comparison: Note both the implied probability and your estimated probability. Over time, tracking these comparisons reveals whether your estimates are accurate.

Practical Example Walkthrough

Scenario 1: Spread bet analysis

You are analyzing Duke -6.5 (-110) against North Carolina.

- Enter -110 in the calculator

- Result: Implied probability = 52.4%

- Your analysis suggests Duke covers 58% of the time based on efficiency margins and home-court advantage

- 58% minus 52.4% = 5.6% expected edge

- This is a mathematically favorable bet worth making

Scenario 2: Moneyline underdog analysis

You like NC State +185 against Miami.

- Enter +185 in the calculator

- Result: Implied probability = 35.1%

- Your analysis suggests NC State wins 42% of the time based on recent form and matchup advantages

- 42% minus 35.1% = 6.9% expected edge

- The positive expected value justifies the bet despite NC State being an underdog

Scenario 3: Finding no value

You want to bet Kentucky -3.5 (-115) against Tennessee.

- Enter -115 in the calculator

- Result: Implied probability = 53.5%

- Your analysis suggests Kentucky covers only 51% of the time

- 51% minus 53.5% = -2.5% expected edge (negative value)

- Pass on this bet; the line does not offer value

Why Implied Probability Matters

The implied probability tells you the break-even win rate. At -110 odds, you must win 52.4% of bets to break even. At -105 odds, you need only 51.2%. This difference seems small but compounds dramatically over hundreds of bets.

The math behind long-term results:

If you bet 100 dollars at -110 and win 52.4% of the time, you break even. Win 55% and you profit significantly. Win 50% and you lose steadily. Understanding implied probability helps you identify which bets clear your required threshold.

Important reminder: The calculator shows mathematical relationships. Actual outcomes depend on countless factors including injuries, motivation, matchups, and variance. Use this tool to inform decisions, not guarantee results. No calculator can predict game outcomes.

Comparing Value Across Sportsbooks

The calculator helps you compare odds across different books. Before placing any bet, check at least 2-3 sportsbooks and use the calculator to see which offers the best implied probability.

| Sportsbook | Odds | Implied Probability | Break-even Win Rate |

|---|---|---|---|

| Book A | -115 | 53.5% | Must win 53.5% to profit |

| Book B | -110 | 52.4% | Must win 52.4% to profit |

| Book C | -105 | 51.2% | Must win 51.2% to profit |

Book C requires the lowest win rate to profit. If you win 53% of your bets long-term, betting at Book C profits while betting at Book A loses money. Over hundreds of bets, this difference compounds significantly and separates winning bettors from losing ones.

Line shopping workflow:

- Find the bet you want to make

- Check odds at all your sportsbooks

- Enter each into the calculator

- Place your bet at the book with the lowest implied probability

- Track which books consistently offer better odds

What is Legal Where (Props, In-State Teams, and Limits)

College sports betting regulations vary dramatically by state. Understanding these restrictions before you bet prevents frustration and ensures compliance. Unlike professional sports where betting rules are relatively uniform across states, college sports face additional scrutiny and limitations.

State Rules Vary: The Big Picture

Most states that allow sports betting permit college basketball wagering on basic markets like spreads and totals. However, many states impose additional restrictions that affect how you can bet:

Player prop restrictions: Multiple states prohibit betting on individual college athlete performance (points, rebounds, assists, and similar markets). This protects young athletes from potential targeting or influence. The concern is that prop markets on specific players could create pressure or inappropriate attention on student-athletes who are not compensated like professionals.

In-state team restrictions: Some states ban betting on teams from that state, either entirely or for specific bet types. For example, you might be able to bet spreads but not player props on local teams. Other states ban all wagering on in-state programs. These rules aim to create separation between local bettors and local athletes.

In-state game restrictions: A few states prohibit betting on any game played within state borders, regardless of which teams are involved. This affects neutral-site tournaments and non-conference games hosted in the state.

Bet type limitations: Some states allow certain bet types (spreads, moneylines, totals) but restrict others (props, live betting, specific parlays) for college sports specifically.

For the complete state-by-state breakdown, see our college sports betting rules guide.

Common Restriction Types

| Restriction Type | What It Means | Example States |

|---|---|---|

| No college player props | Cannot bet on individual player performance (points, rebounds, assists) | NJ, IL, NY, and others |

| No in-state team betting | Cannot bet on teams from your state in any market | Varies by state |

| No in-state game betting | Cannot bet on games played in your state regardless of teams | NJ (example) |

| Limited prop categories | Some props allowed (game props), others banned (player props) | Varies by state |

| Amateur restrictions | Stricter rules for all amateur/college sports vs professional | Multiple states |

New Jersey Example

New Jersey provides a clear example of comprehensive college restrictions. Per state regulations and AP reporting, New Jersey prohibits:

- Betting on any New Jersey college team (Rutgers, Seton Hall, Princeton, and others)

- Betting on any game played in New Jersey, regardless of which teams are involved

- Player props for college athletes across all states, not just New Jersey schools

This means you cannot bet on Rutgers basketball in New Jersey even when they play away games. You also cannot bet on a neutral-site game held at a New Jersey venue like the Prudential Center, even if neither team is from New Jersey.

Practical impact: If you live in New Jersey and want to bet college basketball, plan your bets around these restrictions. Focus on out-of-state games between teams with no New Jersey connection. Track where games are played, not just who is playing.

Why These Restrictions Exist

State legislators impose college restrictions for several interconnected reasons:

-

Protect student-athletes: Young athletes face unique pressures that professional athletes with multimillion-dollar contracts do not. Prop betting could create targeting concerns where bettors focus attention on specific players, potentially leading to inappropriate contact or pressure.

-

Maintain integrity: College sports lack the infrastructure, salaries, and oversight that help insulate professional athletes from corruption. College athletes until recently received no direct compensation, making them theoretically more susceptible to influence. While NIL has changed compensation, concerns remain.

-

Respond to NCAA concerns: The NCAA has lobbied extensively for restrictions on college sports betting. While the organization lost its fight against legal sports betting generally, it has successfully influenced state-level restrictions on college-specific markets.

-

Reduce local conflicts: Restricting bets on local teams reduces potential conflicts between community members who bet and student-athletes who live in the same community. This is particularly relevant for smaller college towns.

-

Political considerations: Legislators in states with prominent college athletic programs face pressure from universities, alumni groups, and athletic departments to protect their institutions from gambling-related concerns.

Check Before You Bet

Before placing any college basketball bet, follow this verification process:

- Confirm your state allows college sports betting (most do, but verify)

- Check if player props are permitted for college athletes in your state

- Verify you can bet on specific teams (in-state restrictions may apply)

- Check where the game is played (some states restrict bets on games within their borders)

- Use your sportsbook app to see available markets (restricted markets are typically grayed out)

- Verify before tournament season when neutral-site games may trigger restrictions

If You Cannot Bet Player Props, What Can You Bet Instead

When player props are unavailable, several alternatives offer similar engagement and analytical opportunities. Many successful bettors actually prefer these markets because they can be less efficient than heavily-bet player props.

Team totals: Bet on one team to score over or under a set number. This relates to player performance without targeting individuals. Example: Duke team total Over 78.5 (-110). If you believe Duke will score heavily based on their offensive efficiency, you can express that view without betting on any specific player. Team totals often correlate with the analysis you would do for player props anyway.

First half and second half lines: Bet spreads or totals for specific halves. This creates more action opportunities without props. If you have insight into how teams perform in different halves (some teams start fast, others close strong), half lines let you capitalize on that analysis. Example: Kentucky 1H -3.5 if they typically dominate the first half.

Alternate spreads and totals: Bet adjusted lines at different odds. Example: Instead of Kansas -5.5 (-110), take Kansas -2.5 (-180) for more security or Kansas -8.5 (+150) for higher payout. Alternate lines let you customize your risk and reward profile based on your confidence level.

Game props: Where legal, bet on game outcomes like winning margin range (team to win by 1-5 points, 6-10 points, etc.), first to 20 points, or highest-scoring half. These focus on team performance rather than individuals. Not all states allow game props, but many that ban player props permit team-focused alternatives.

Live betting: Bet during the game as lines shift. This provides continuous engagement without relying on player props. Live betting lets you react to what you see rather than predicting individual performances in advance. Many bettors find live markets offer better value because lines adjust more slowly to game flow than expected.

Futures markets: If you cannot bet player props for daily action, consider futures on conference champions, tournament outcomes, or win totals. These markets do not involve individual player betting and are available in most states.

| Alternative | Why It Works | Example |

|---|---|---|

| Team totals | Reflects offensive output without naming players | Gonzaga Over 82.5 |

| Half lines | Doubles betting opportunities per game | UNC 1H -2.5 |

| Alt spreads | Customize risk/reward based on confidence | Kentucky -1.5 (-160) |

| Game props | Team-focused outcomes without player targeting | Duke to win by 6-10 |

| Live betting | React to game flow in real time | 2H totals, live spreads |

Key insight: Many successful college basketball bettors focus on team totals and half lines even in states where player props are available. These markets are often less efficient because they receive less public attention. If props are unavailable in your state, you are not necessarily at a disadvantage.

Best College Basketball Betting Sites (How to Choose)

Choosing the right sportsbook matters for college basketball bettors. Not all books offer the same markets, odds, or limits. With over 350 Division I programs and hundreds of games each week during the season, you need sportsbooks that cover the full landscape of college basketball, not just marquee matchups.

What to Look For

NCAAB market depth: Does the book offer lines on mid-major games, not just Power Five matchups? Conference USA, the Sun Belt, and the Missouri Valley all produce betting opportunities. Are first half, second half, and team totals available for most games? The best books post lines on 150+ games per night during peak season.

Competitive odds: Compare -110 lines across books. Some consistently offer -105 or better on standard spreads. Over a season of 200+ bets, the difference between -110 and -105 juice adds up to significant money. Track which books offer reduced juice on NCAAB specifically, as some books are more competitive in college markets than NBA.

Live betting quality: How quickly do live lines update? Can you bet during timeouts and media breaks? Low-latency live betting creates opportunities, especially in college basketball where momentum swings happen frequently. Test the live betting interface during games before committing significant action.

Betting limits: Some books limit sharp bettors quickly after a few winning weeks. If you plan to bet seriously and expect to win, research limit policies before depositing large amounts. Books known for limiting winners may not suit your needs even if they offer good odds initially.

Cash-out options: Can you close positions early? Cash-out can be useful for managing risk on futures or locking in profits on spreads. However, cash-out pricing typically favors the book, so use it strategically rather than habitually.

Mobile experience: Most NCAAB betting happens on mobile during games. The app should be fast, reliable, and easy to navigate. Test navigation speed, bet slip functionality, and live betting responsiveness before the season starts.

Early line availability: When does the book release lines? Some books post NCAAB lines the morning before games, while others wait until afternoon. Early lines often offer the best value before the market sharpens.

Promotions and boosts: Does the book offer odds boosts on NCAAB games? Are there parlay insurance options or profit boosts for college basketball specifically? March Madness typically brings extensive promotions across all major sportsbooks.

Sportsbook Selection Checklist

Use this checklist when evaluating sportsbooks for college basketball betting:

| Factor | Questions to Ask | Why It Matters |

|---|---|---|

| Markets | Are mid-major games available? Halves? Team totals? | More markets mean more opportunities to find value |

| Odds | How does standard juice compare to competitors? | Lower juice increases long-term profitability |

| Limits | What are maximum bet sizes for NCAAB? | Higher limits allow scaling winning strategies |

| Live betting | How responsive are in-game lines? | Fast updates create opportunities during games |

| Line timing | When are lines first posted each day? | Early lines often offer the best value |

| Promotions | Are NCAAB boosts and promos offered regularly? | Boosts can provide positive expected value |

| Withdrawals | How fast can you access winnings? | Fast withdrawals enable bankroll management |

| Support | Is customer service responsive for betting issues? | Problems during live betting need quick resolution |

Line Shopping Strategy

Maintain accounts at multiple licensed sportsbooks. This is not optional for serious bettors. Line shopping is the simplest edge available to recreational and sharp bettors alike.

Before each bet:

- Check the line at 2-3 books minimum (ideally 4-5 during peak season)

- Note juice differences (-110 vs -105 vs -115)

- Look for half-point differences on spreads (a half-point swing on college basketball spreads affects outcomes regularly)

- Check total availability if your primary book does not have the total you want

- Place your bet at the book offering the best value

Example of line shopping impact:

You bet 50 games during the season at 20 dollars each. At -110 juice, you need to win 52.4% to break even. At -105 juice, you need only 51.2%. If you win 53% of bets:

- At -110 average juice: You profit approximately 40 dollars over the season

- At -105 average juice: You profit approximately 120 dollars over the season

The difference is 80 dollars on modest volume. Scale up to larger bets or more games, and line shopping becomes worth hundreds or thousands of dollars annually.

When line shopping matters most:

- Conference tournament week (lines vary significantly across books)

- Early-season non-conference games (less sharp action means wider discrepancies)

- March Madness first round (massive betting volume creates opportunities)

- Weeknight mid-major games (less attention means softer lines)

Even small edges compound over a full season of betting. The time spent checking 3-4 books takes 30 seconds per bet and is always worth it.

FTC Disclosure: If we recommend specific sportsbooks, we may receive compensation. All recommendations are based on our editorial evaluation. Only use licensed, regulated sportsbooks in your state.

College Basketball Betting Strategy (Sharp-Friendly, Plain English)

Moving beyond basics, this section covers the analytical frameworks sharp bettors use. These concepts are accessible without subscriptions or advanced tools.

Tempo: Why Possessions Drive Totals

Tempo measures how many possessions a team uses per game. High-tempo teams push pace, creating more scoring opportunities. Low-tempo teams grind, reducing total points.

Why tempo matters for betting:

Two teams averaging 75 points per game might produce very different totals depending on tempo. A 75-point team playing at 70 possessions produces differently than one playing at 65 possessions.

Practical application:

Before betting totals, ask:

- Does this team push pace or slow it down?

- Can the opponent match or control tempo?

- Is the total priced for the expected pace?

Fast-paced matchups (Gonzaga vs a similar team) tend to have higher totals. Grind-it-out Big Ten matchups between defensive teams go under more often.

Efficiency: Points Per Possession

Efficiency measures how well teams score (offensive efficiency) and defend (defensive efficiency) on each possession.

Offensive efficiency: Points scored per 100 possessions Defensive efficiency: Points allowed per 100 possessions

A team scoring 1.10 points per possession (110 per 100) is elite offensively. A team allowing 0.95 points per possession (95 per 100) is elite defensively.

Why efficiency beats raw scoring:

A team scoring 80 points looks impressive until you realize they needed 85 possessions. A team scoring 70 points on 60 possessions is actually more efficient.

KenPom-Style Thinking Without the Paywall

KenPom ratings (available at kenpom.com) are the gold standard for college basketball analytics. While detailed data requires a subscription, you can apply the concepts for free by understanding what the metrics measure and finding comparable data elsewhere.

What KenPom actually measures:

- Adjusted offensive efficiency: Points scored per 100 possessions, adjusted for opponent quality

- Adjusted defensive efficiency: Points allowed per 100 possessions, adjusted for opponent quality

- Adjusted tempo: Possessions per 40 minutes, adjusted for opponent pace

- Luck rating: How results differ from expected outcomes based on efficiency

The adjustment for opponent quality is key. Scoring 80 points against Kansas means more than scoring 80 against a mid-major.

The 5-step workflow for bettors:

- Find tempo numbers: Search for team tempo rankings (multiple free sources exist including ESPN, basketball-reference, and college basketball analytics sites)

- Compare efficiencies: Look for adjusted efficiency margins (offensive minus defensive). A +15 margin is elite. A +5 margin is good. Negative margins suggest a team is overperforming their underlying quality.

- Check strength of schedule: A 15-2 team in a weak conference differs from 15-2 in the Big 12. Free SOS rankings are available from multiple sources.

- Note home/away splits: Efficiency often drops significantly on the road. A team with +12 home efficiency margin might be +4 on the road.

- Watch for variance: Early-season numbers are noisy; trust larger sample sizes. By February, efficiency data is more reliable than November.

Practical application example:

You want to bet Team A (-4) against Team B. Your free research shows:

- Team A: +8 efficiency margin, moderate tempo, tough SOS

- Team B: +3 efficiency margin, slow tempo, weak SOS

The 5-point efficiency gap suggests Team A should be favored by 5-8 points (depending on home court). Getting them at -4 looks like value.

Free resources to check:

- Team stats on ESPN, CBS Sports, and similar sites

- Efficiency margins on basketball-reference (team stats section)

- Tempo data on various college basketball analytics sites

- NCAA official statistics for raw numbers

You do not need subscriptions to apply these concepts. The framework matters more than the exact numbers. Paid sites offer convenience and precision, but free data supports solid analysis.

Home-Court, Travel, and Environmental Factors

Home-court advantage is stronger in college basketball than professional sports. Consider:

Student sections: Cameron Indoor (Duke), Allen Fieldhouse (Kansas), and similar venues create genuine advantages. Home teams in hostile environments outperform expectations.

Altitude: BYU, Colorado, and Air Force play at elevation. Visiting teams often struggle, especially in the first half.

Travel spots: Watch for teams playing far from campus on short rest. A West Coast team traveling to the East Coast for a noon game faces real disadvantages.

Neutral sites: Early-season tournaments at neutral locations (Maui, Bahamas, Las Vegas) remove home advantage entirely. Some teams perform very differently away from campus.

Rematches and Conference Play Adjustments

In conference play, teams face each other twice. The second matchup often differs significantly:

Coaching adjustments: Good coaches adapt. A team that got torched by a specific action in Game 1 will have answers in Game 2.

Personnel changes: Injuries, suspensions, and rotation changes between matchups matter.

Motivation differences: A team that lost badly seeks revenge. A team that won easily might be overconfident.

Line value: The market often overreacts to Game 1 results. If Duke beat UNC by 15 in the first meeting, the second matchup line might be inflated.

Early Season Volatility (NIL, Transfers, Freshmen)

October through December features maximum uncertainty. Understanding this volatility gives patient bettors significant advantages.

Transfer portal impact: The modern transfer portal has fundamentally changed roster construction. Teams add and lose players constantly throughout the offseason and even during the season. Preseason projections based on last year rosters quickly become outdated. A team projected top 10 might lose three starters to the portal. A mid-major might gain a Power Five starter seeking playing time.

How this affects betting: Opening lines reflect preseason rankings and projections. If those projections rely on players who transferred, the lines may be mispriced for weeks. Track portal movement closely before the season starts.

NIL deals: Name, Image, and Likeness money creates new dynamics. Top players now have financial incentives to transfer to programs offering better NIL packages. This makes roster construction less predictable than ever. Schools without strong NIL collectives may lose talent mid-season if deals emerge elsewhere.

Freshman integration: Five-star recruits dominate preseason hype but need time to adapt. The college game is faster and more physical than high school. Defensive schemes are more complex. Even elite freshmen rarely perform at their ceiling until January or February.

Scheduling quirks: Early-season tournaments (Maui Invitational, Battle 4 Atlantis, Phil Knight Invitational) provide neutral-site data but small samples. Teams playing three games in three days in November show fatigue and depth issues that may not appear later.

Strategy for early season:

- Bet smaller stakes while rosters stabilize

- Focus on teams with returning cores (70%+ minutes returning is a stability marker)

- Avoid heavy favorites whose lines assume preseason rankings are accurate

- Track results for later-season edges (note teams that exceed or disappoint early expectations)

- Watch for coaching changes and system adjustments (new coaches need time to install schemes)

The December transition: By mid-December, most teams have played 8-10 games. Conference play begins in January with cleaner data. The most mispriced lines often appear in November when projections are untested. By conference play, you have real data to work with and markets become more efficient.

Betting Splits, Public Money, and Line Movement

Understanding market dynamics helps you identify value and avoid traps. While betting splits and line movement analysis can supplement your handicapping, they should not replace fundamental analysis of the teams involved.

What Betting Splits Are (And What They Are Not)

Betting splits show the percentage of bets and money on each side of a wager. Example: 70% of bets on Duke, 30% on UNC.

Most free betting split trackers show two numbers: bet percentage (number of tickets) and money percentage (dollar volume). These often differ significantly. A game might have 75% of bets on Duke but only 55% of money. This means Duke is popular with casual bettors placing smaller wagers, while sharper money (larger bets) leans toward UNC.

What splits tell you:

- Which side the public prefers (bet percentage)

- Where larger money is going (money percentage)

- General sentiment on a game

- Which games are attracting heavy action

What splits do NOT tell you:

- Who will win the game

- Where professional sharp money definitively is (sharps use multiple accounts and strategies to hide activity)

- What the correct line should be

- Whether fading the public will profit

Public betting percentages are interesting but not predictive on their own. The public is not always wrong. Popular teams like Duke, Kansas, and North Carolina often win and cover. Fading the public blindly loses money over time.

When splits might matter:

College basketball has unique split dynamics because of the volume of games. On a Tuesday night with 80+ games, most public attention focuses on the 5-6 televised matchups. The other 75 games receive less action, meaning lines are often softer. When a mid-major game shows 85% of bets on one side, it might just mean 200 people bet the game and 170 picked the favorite.

Reverse Line Movement

Reverse line movement occurs when the line moves opposite to betting percentages. Example: 75% of bets are on Duke -3, but the line moves to Duke -2.5.

This is often cited as a sharp betting indicator, but understanding why it happens matters more than blindly following the signal.

Possible explanations:

- Sharp money on the underdog: Professional bettors placing large bets on UNC push the line despite public preference for Duke. Sportsbooks respect sharp action and adjust accordingly.

- Injury news not yet public: The sportsbook may have information (through betting patterns or sources) about an injury that casual bettors do not know yet. The line adjusts before the news breaks.

- Sportsbook risk management: Books may adjust lines to balance their exposure, especially on nationally televised games where they might have heavy liability on one side.

- Stale opening line: Sometimes the opening line was simply wrong, and sharp action early corrected it before public betting began.

How to use reverse line movement:

- Note when it occurs but do not bet blindly based on it

- Look for the reason behind the movement (news, sharp reports, line shopping discrepancies)

- Combine with your own analysis to determine if you agree with the sharp side

- Track your results when betting with and against reverse line movement to see if it adds value for you

Reverse line movement sometimes indicates sharp activity, but not always. Use it as one data point among many rather than a betting system.

A Practical Market Intel Workflow

For games you are seriously considering, follow this systematic process to gather market intelligence before placing your bet:

-

Check opening line: Where did the line open when first released? Most books release college basketball lines the morning before games. Opening lines represent the sportsbook initial assessment before public betting begins. Note the opener because comparing it to current lines reveals market sentiment.

-

Track movement: How has the line changed since opening? A line moving from -3 to -4.5 tells you money is coming in on the favorite. Moving from -3 to -2 suggests underdog action or sharp money. Movement of 1.5 points or more is significant in college basketball.

-

Note betting splits: What side is the public on? Free betting percentage trackers show where recreational bettors are concentrated. High public percentages often indicate popular teams or televised games. Compare bet percentage to money percentage for insights.

-

Identify divergence: Is the line moving opposite to public sentiment? This reverse line movement can indicate sharp action but is not guaranteed. Look for explanations before assuming sharps are on a side.

-

Look for news: Any injury updates, travel issues, or lineup changes? Check team beat writers on social media for practice reports and injury news that may not be widely published. Local beat reporters often have information before national outlets.

-

Check totals movement: Sometimes spread movement is minimal but totals move significantly. This can indicate weather news, pace information, or injury impacts that affect scoring without changing the spread.

-

Make your decision: Combine market intel with your own analysis. Market information supplements your research but should not replace it. If your analysis says one thing and the market says another, understand why before betting.

| Signal | Possible Meaning | Caution |

|---|---|---|

| Heavy public side + line moves toward them | Public money driving movement | Does not mean the public is right |

| Heavy public side + line moves against them | Possible sharp activity on other side | Could be injury news or other factors |

| Line moves with no obvious catalyst | Someone has information you do not | Could be wrong or already priced in |

| Total moves but spread stays flat | Pace or injury information affecting scoring | May not affect game outcome |

| Line moves back to opener after sharp move | Market disagreement or steam chase correction | Original sharp move may have been wrong |

Warning: Market signals are useful context but not guaranteed edges. Many bettors overthink splits and movements when simple analysis would serve better. The best edge comes from understanding teams, not from chasing line movements. Use market intel to confirm or question your analysis, not as a primary betting strategy.

Futures and Season Arcs (Preseason to March)

Futures betting allows you to wager on outcomes determined over weeks or months rather than single games. College basketball futures span from preseason title odds to conference championships, win totals, and tournament-specific markets. Understanding when and how to bet these markets can add significant value to your betting portfolio.

Futures Types in College Basketball

National championship: Bet on which team wins the NCAA Tournament. Example: UConn +600 to win title. This is the highest-variance futures market with the largest potential payouts. Only one team wins from a field of 68, meaning even the best teams have roughly 10-15% true probability of winning. Title odds reflect both team quality and tournament variance. A team at +600 implies roughly a 14% chance, but actual probabilities for even elite teams rarely exceed 15-20% given single-elimination variance.

Final Four: Bet on a team reaching the Final Four. Lower payout than championship but higher probability. Making the Final Four requires winning four tournament games, while winning the title requires six. This gives you roughly 4x the probability for lower odds. Final Four bets offer a middle ground between the extreme variance of title bets and the lower payouts of conference markets.

Conference champion: Bet on which team wins a specific conference regular-season title (Big Ten, SEC, ACC, etc.). These markets open before the season and update as conference play progresses. Conference titles are often shared, which affects payout structures. Some books pay full odds on ties; others use dead-heat rules that reduce payouts. Check rules before betting. Conference champion markets offer lower variance than national title markets because they do not depend on tournament results.

Conference tournament winner: Bet on tournament champions, which differs from regular-season titles. Conference tournaments create chaos, especially in leagues where anyone can win four games in four days. The Big East, Big 12, and SEC tournaments regularly produce surprises. Consider team depth, tournament location, and seeding when evaluating conference tournament futures.

Win totals: Some books offer over/under on regular-season wins. Less common than other sports but available at major sportsbooks. Example: Duke Over/Under 26.5 wins. Consider strength of schedule, non-conference opponents, and depth before betting win totals. Win totals often provide value because they depend on full-season performance rather than single-game or tournament variance.

Make the tournament: Some books offer odds on whether specific teams make the 68-team NCAA Tournament field. This is useful for bubble team speculation. Monitor NET rankings, strength of schedule, and quality wins to project bubble teams. These markets become active in February as the tournament picture clarifies.

Regional and seed props: Closer to Selection Sunday, you may find props on seed ranges (Team X to be a 1-seed, Team Y to be a 12-16 seed). These can offer value based on bracket projection analysis. If you follow bracketology closely, seed props let you capitalize on that knowledge.

When Value Tends to Appear

Preseason (September-October): Lines reflect perceptions, not reality. If you have strong opinions on teams before data exists, this is when to act. Preseason futures are based on returning players, recruiting rankings, and coaching perception. If you believe the market is wrong about a team, preseason offers the best prices. Risk: Maximum uncertainty. Rosters change, injuries happen, and early projections often miss badly.

Early season (November-December): Overreactions to small samples create value. A team that loses badly in Maui might drop too far in title odds. A team that beats a ranked opponent in November might see odds tighten too quickly. Look for teams whose underlying quality differs from their early record.

Pre-conference (January): Conference play begins with cleaner data. Teams you like trading at better prices than preseason. By January, you have 10-15 games of real data per team. Efficiency metrics stabilize. Teams that started slow but have strong underlying metrics may offer value as their odds remain deflated.

Pre-tournament (February-March): Selection Sunday approaches. Bubble teams and bracket projections become clearer. Some prices tighten; others present value. Teams locked into specific seed lines may offer value if the market has not adjusted. Watch for teams with favorable bracket paths.

During tournament: Live futures odds shift dramatically with each game. A Cinderella run can present hedging opportunities. If you hold a futures ticket on a team that reaches the Sweet 16 or Elite Eight, consider hedging to lock in profit regardless of outcome.

Futures and March Madness

As March approaches, futures betting increasingly relates to the NCAA Tournament. Your regular-season futures become tournament propositions.

Hedging strategies: If you bet Duke to win the title at +800 preseason and they reach the Final Four, their odds might be +300. You can hedge by betting against them in individual games to guarantee profit. Calculate hedge amounts to ensure positive outcomes regardless of results.

Live tournament futures: During the tournament, futures odds update after every game. Sweet 16 odds differ from Elite Eight odds. If you see a team you like after their first win, you can still bet futures at updated prices.

For comprehensive tournament betting strategy, including bracket analysis, upset patterns, and live tournament betting, see our March Madness betting guide.

Refresh cadence for futures:

- Check title odds weekly during regular season to track market movements

- Increase attention in February as brackets take shape and bubble teams clarify

- Monitor during conference tournaments when seeds get locked and paths become clearer

- Adjust positions after Selection Sunday based on actual bracket matchups

- Consider hedging during the tournament as your positions gain value

Historical note: Selection Sunday for 2025 was March 16, 2025. The tournament schedule follows similar timing each year, with the Final Four typically two weeks after Selection Sunday.

Live Betting, First Half and Second Half Markets

In-game betting has grown dramatically, and college basketball offers unique live opportunities.

Why Halves Matter More in NCAAB

Unlike the NBA with its four quarters, college basketball plays two 20-minute halves. This structure creates distinct betting markets and strategic opportunities that NBA bettors miss.

First half lines: Bet on spread or total for the first 20 minutes only. Useful when you expect one team to start strong or when analyzing teams with different first-half and second-half tendencies. Some teams come out aggressive in the first half, pressing and running. Others take time to settle into games.

Second half lines: Lines released at halftime based on first-half performance. Often more efficient than pre-game lines because they incorporate actual data from the first 20 minutes. However, value emerges when the market overreacts to first-half results.

Why halves create value:

- Teams play different styles in each half (some teams press harder early; others grind late)

- Foul trouble accumulates and affects second-half lineups

- Fatigue compounds, especially for teams playing back-to-back

- Coaches make halftime adjustments that can swing the second half

- The best teams often dominate second halves as conditioning and depth matter more

- Some coaches are known for excellent halftime adjustments while others are not

Common first-half betting angles:

- Teams that press early tire in the second half. Bet first-half over, game under.

- Teams with young guards often start slow. Bet against them first half, with them second half.

- Road teams in hostile environments struggle early. First-half spread advantages for home teams.

- Back-to-back games favor fresh teams in the first half before legs tire.

Second-half adjustments to watch:

- Did the underdog keep it close? The favorite may pull away as depth matters.

- Did a team go cold from three? Regression happens in both directions.

- Did a key player pick up early fouls? They may dominate the second half.

- Is one coach known for superior adjustments? Bet accordingly.

Simple Live-Bet Triggers

If you bet live during games, watch for these situations:

Pace mismatch: One team wants to push tempo, the other wants to slow down. Whoever controls pace often covers.

Foul trouble: A star player picks up two early fouls and sits. The live line may not fully adjust.

Bench depth: Some teams have massive drop-offs when starters rest. Watch for extended bench minutes.

Shooting variance: A team making 60% from three early will likely regress. If the line hasn't adjusted, the other side has value.

Momentum shifts: College basketball features dramatic runs. A 15-0 run shifts the game, but live lines sometimes lag.

Responsible Live Betting

Live betting carries higher risk for impulsive decisions. Before betting in-game:

- Set a live betting budget separate from pre-game bets

- Avoid chasing losses during games

- Take timeouts (literally) to think before clicking

- Do not let one bad beat lead to multiple live bets

The speed of live betting can lead to poor decisions. Stay disciplined.

NCAA vs NBA Betting: Key Differences

If you bet the NBA, understanding how college basketball differs improves your results. The two sports share fundamentals but differ significantly in structure, variance, and market dynamics. Successful NBA bettors who struggle with college basketball often fail to account for these differences.

Halves vs Quarters

The NBA plays four 12-minute quarters. College plays two 20-minute halves. This structural difference affects multiple aspects of betting:

- Timeout distribution: College coaches have fewer natural breaks, making momentum harder to stop. A 10-0 run in college often becomes 15-0 before a timeout.

- Foul situations: Bonus free throws work differently. In college, the bonus kicks in at the seventh team foul per half (one-and-one), with double bonus at 10 fouls. The NBA uses team fouls per quarter. This changes late-game strategy significantly.

- Betting markets: Half lines dominate in college (first half spread, second half spread). NBA offers quarter lines that do not exist in college betting. If you rely on quarter props in NBA, you need a different approach for college.

- Halftime adjustments: The longer halves mean more time for coaches to identify and exploit weaknesses before halftime. Second-half adjustments often swing games differently than quarter-by-quarter NBA shifts.

Depth and Rotation Volatility

NBA teams have 8-10 players in regular rotations with predictable minutes. Star players average 32-36 minutes with consistent roles. College teams vary dramatically:

- Some coaches play 6-7 players with heavy starter minutes (predictable but fatigue-prone)

- Others use 10+ players in unpredictable rotations (high variance outcomes)

- Foul trouble has larger impact with less depth (one player with three first-half fouls can swing a game)

- Injuries devastate thin rosters more severely (losing one starter might mean losing the game)

- Freshmen minutes vary widely early in the season as coaches figure out rotations

Betting implication: When betting college basketball, check rotation depth. A team with nine capable players handles foul trouble and fatigue better than a team relying on five starters. In February conference play, depth matters more than in November when legs are fresh.

Officiating and Late-Game Free Throws

College officiating is less consistent than the NBA. The referee pool is larger and less standardized, creating game-to-game variance in how tightly fouls are called.

This affects betting in several ways:

- Foul calls: More variability in how physical games are called. A crew that lets teams play physical advantages defensive teams. A crew calling tight fouls sends everyone to the line.

- Free throw rates: Some teams get to the line far more than others based on style. Post-heavy teams draw fouls; perimeter teams do not. Check free throw rate differentials before betting totals.

- Late-game situations: Intentional fouling and free throw variance swing covers regularly. A team shooting 65% from the line is a liability in close games.

- Pace of play: College games often slow down in the final minutes due to fouling strategy. This affects second-half totals and live betting lines.

Practical tip: Before betting close spreads (3 points or fewer), check free throw percentages for both teams. A team shooting 78% from the line has a significant edge in close games over a team shooting 67%.

Neutral-Site Tournaments and Travel Spots

The NBA has consistent home/away splits with established travel routines. College basketball features unique situations:

- Neutral-site tournaments: Maui, Battle 4 Atlantis, Phil Knight events, and Vegas showcases eliminate home-court advantage entirely. Some teams thrive at neutral sites; others struggle away from their home environment.

- Non-conference road trips: Teams travel to distant locations for guarantee games or resume-building matchups. A West Coast team playing at 11 AM Eastern is at a real disadvantage.

- Conference tournament neutral sites: Most conference tournaments occur at neutral venues. The Big East at Madison Square Garden favors East Coast programs. The Pac-12 in Las Vegas is a different environment.

- True road games: College road games in hostile environments (Cameron Indoor, Phog Allen, Rupp Arena) create larger home advantages than any NBA arena. Student sections create noise and distraction that professional arenas cannot match.

Betting implication: Track neutral-site performance separately from home and road records. Some teams play significantly better or worse without their home crowd. Early-season tournament performance provides useful data for March neutral-site tournament betting.

For comprehensive NBA betting strategy, see our NBA betting guide.

Mistakes to Avoid

Even experienced bettors make these common errors in college basketball. Avoiding these pitfalls improves your results more than finding one extra edge.

Betting Too Many Games

With 150+ games some nights, the temptation to bet extensively is real. College basketball volume is both an opportunity and a trap. Problems arise when:

- You bet games you have not researched because the volume feels like you are missing out

- You follow others picks without understanding the reasoning behind their selections

- You chase action for entertainment value rather than expected profit

- You feel compelled to bet every televised game regardless of edge

Why this hurts: Each additional bet without an edge increases your exposure to the house advantage. Betting 20 games at -110 with no edge guarantees long-term losses. The juice compounds with volume.

Solution: Focus on games where you have genuine insight. Betting 3-5 games with conviction beats betting 20 games randomly. Quality over quantity is the first principle of successful sports betting. If you cannot articulate why a bet has value, skip it.

Ignoring Legality and Prop Restrictions

Assuming all bets are available leads to frustration when:

- Your sportsbook grays out a player prop you wanted to bet

- You cannot bet on your local team due to state restrictions

- You did not realize your state has college-specific limitations

- You build a strategy around props that are not available in your jurisdiction

Why this matters: Time spent analyzing unavailable bets is wasted. Frustration from restrictions can lead to poor substitute bets made hastily.

Solution: Check state rules before building your betting strategy. Know what markets are available before investing research time. Adapt your approach to your state regulations rather than fighting them.

Overreacting to Trends Without Context

Trends like winning their last 8 home games or covers in 6 of 7 are interesting but often meaningless:

- Sample sizes are too small to be statistically significant

- The trend may reflect a specific schedule strength that will not continue

- Past results do not predict future outcomes without causal explanation

- Trends ignore the changing nature of college rosters and matchups

Why trends mislead: A team covering 6 of 7 might have faced weak opponents or benefited from favorable line movements. The trend tells you what happened but not why. Without understanding the why, you cannot predict if it will continue.

Solution: Use trends as starting points for analysis, not conclusions. When you see an interesting trend, ask why it happened. If you can identify a sustainable cause (strong defense, elite home court, deep bench), the trend has meaning. If you cannot explain it, treat it as noise.

Not Tracking Results

Without records, you cannot:

- Identify what bet types work for you (spreads vs totals vs moneylines)

- Measure closing line value, which indicates whether your analysis is sound

- Spot leaks in your approach (maybe you lose on road favorites consistently)

- Understand true ROI across different leagues, bet types, and situations

- Prove to yourself whether you are actually profitable

Why tracking matters: Memory is unreliable. Bettors remember their wins and forget their losses. Without objective records, you cannot improve because you do not know what needs fixing.

Solution: Track every bet from day one. Use a spreadsheet or betting tracker app. Record the date, teams, bet type, odds, closing line, and result. Review monthly to identify patterns. Adjust your approach based on data, not feelings.

Chasing Losses During Games

Live betting makes chasing losses easy and dangerous:

- You lose a pre-game bet and immediately place a larger live bet to recover

- You double down on the same team when they fall behind

- You bet impulsively during games without the research you would do pre-game

Solution: Set a live betting budget separate from pre-game bets. When you hit your limit, stop. Taking a break during a losing night prevents compounding damage.

Betting Recap Checklist

Before each bet, confirm:

- You have researched both teams (not just checked the spread)

- You understand why the line is set where it is and why you disagree

- You have checked legality for this bet type in your state

- You have compared lines across sportsbooks and are getting the best number

- You are betting an amount you can afford to lose without affecting your life

- You can articulate the specific edge you believe you have

Frequently Asked Questions

Can you bet on college player props in my state?

It depends on your state. Many states including New Jersey, Illinois, and New York prohibit player props for college athletes entirely. The rationale is protecting young student-athletes from potential targeting or undue pressure. Other states allow college player props with restrictions, such as banning certain prop types or limiting markets for in-state schools.

Check your state rules for current regulations. Regulations change periodically as states update their gambling laws, so verify before assuming a market is available.

Where props are banned, consider team totals, half lines, alternate spreads, and game props as alternatives. These markets let you express similar opinions without betting on individual players.

Why can I not bet on in-state college teams?

Some states prohibit betting on teams from that state to protect local student-athletes and maintain the integrity of college sports. The concern is that local betting could create inappropriate relationships between bettors and players, or that student-athletes might face pressure or targeting from local gamblers.

New Jersey, for example, bans betting on any New Jersey college team (Rutgers, Seton Hall, Princeton) and any game played in the state, regardless of which teams are involved. If a neutral-site tournament is held in New Jersey, residents cannot bet on any games at that venue.

These restrictions vary by state. Some states only restrict props on in-state teams while allowing spreads and totals. Others ban all wagering on local programs. Check your specific state regulations to understand what is permitted.

Does overtime count in college basketball betting?

Yes, overtime counts for standard betting markets including spreads, moneylines, and game totals. If you bet Duke -5.5 and the game goes to overtime with Duke winning by 6, your bet wins. The overtime period is part of the official game result.

Exceptions to know:

- First half and second half bets only count their respective 20-minute periods. Overtime does not affect half bets.

- Some prop bets may specify regulation only, meaning overtime does not count. Always read bet terms carefully before placing prop wagers.

- Live bets placed during overtime follow standard rules unless specified otherwise.

When in doubt, check the bet terms on your sportsbook or contact customer support before placing the bet.

What do plus 150 and minus 110 odds mean in college basketball?

Minus 110 (-110) means you risk 110 dollars to win 100 dollars. This is the standard juice on spread bets, implying you need to win 52.4% of bets to break even over the long term. The negative number indicates the favorite or favored side.

Plus 150 (+150) means you win 150 dollars on a 100-dollar bet. This is typically seen on underdogs and implies a 40% win probability based on the odds. The positive number indicates the underdog or less likely outcome.

To convert any odds to implied probability or compare across formats, use our odds converter above. Understanding implied probability helps you identify when the market offers value compared to your own estimates.

When are NCAA basketball lines released?

Most sportsbooks release college basketball lines the day before games, typically in the morning Eastern time. The exact timing varies by sportsbook and game importance.

Timing patterns:

- Major games (ranked matchups, rivalry games, nationally televised) may post earlier, sometimes 2-3 days before tip-off

- Mid-major games often post later, sometimes only 12-18 hours before the game

- Conference tournament and NCAA Tournament lines typically release within hours of the previous game ending

Opening lines often offer the best value because they represent the sportsbook initial assessment before public betting begins. Sharp bettors often target opening lines. As betting action comes in, lines adjust to balance the books. Check your sportsbook for their specific release schedule and set alerts for games you want to bet early.

What is better: moneyline or spread in college basketball?

It depends on the game and your analysis. Neither bet type is universally better; each serves different situations.

Use spreads when:

- Games are expected to be competitive

- Betting favorites (spreads offer better value than paying heavy moneyline juice)

- You have a strong opinion on margin of victory

Use moneylines when:

- Betting underdogs you believe can win outright

- The spread feels too risky but you like the team to win

- Small favorites where moneyline juice is reasonable (-130 to -160 range)

General rule: For heavy favorites (-250 or worse on moneyline), spreads are almost always more efficient. For underdogs you think can win, moneylines pay better than covering a spread. Match the bet type to your specific edge and analysis.

Responsible Gambling Notice

College basketball betting should be entertaining, not a source of financial stress. Before you bet:

- Set a budget: Only bet money you can afford to lose

- Track your bets: Know your results and patterns

- Take breaks: If betting stops being fun, step away

- Never chase losses: Accept losses as part of betting

- Be honest with yourself: If you are hiding bets or borrowing to bet, seek help

Gamble responsibly. If you or someone you know has a gambling problem, call +1-800-GAMBLER.